Corzine Fails To Address Staggering Costs For Public Employee Health Care

Healthcare costs for state workers and retirees are projected to double—from $1.4 billion to $2.8 billion in five years. Post-retirement medical costs for teachers are expected to more than double—from $750 million this year to $1.8 billion in just five years.In his April testimony before the state Senate Budget and Appropriations Committee, New Jersey State Treasurer Bradley Abelow said:

In addition to the unfunded pension liability, our actuary’s preliminary estimate of the State’s future liability for postretirement medical benefits for current and future retirees is a staggering $78 billion.These staggering costs for public employee health care and other benefits needed to be addressed in this year’s contract negotiations with state worker and teachers’ unions. Instead, Corzine agreed to a sweetheart deal that had unions bragging about the best deal they’ve negotiated in 15 years.

The new four-year union contact had one element to address retiree health care costs - future retirees were to have contributed 1.5 percent of their pensions toward the cost of their health benefits. Now, even that small concession has been abandoned.

Just three months after signing off on a landmark state worker contract that traded generous pay hikes for increased employee payments toward health benefits, Gov. Jon Corzine's administration is backing away from one key feature of the new pact.Under the amended agreement retired workers will be able to continue getting free health insurance if they sign up for a "wellness program". Paid for by taxpayers, of course.

[T]he Corzine administration has agreed to scrap a requirement that future retirees contribute 1.5 percent of their pensions toward the cost of their health benefits.

"The change is de minimis relative to the overall scale of what has occurred," Corzine said.Compared to a $78 billion obligation nearly any amount is “de minimis”, including the total of New Jersey state assets, valued at $35.4 billion, according a recent report by Credit Suisse.

Corzine’s excuse for caving into union demands after the contract had been ratified by union members only serves to highlight the incompetence of his administration. The new and improved healthcare plan won’t be ready until April 1 rather than January 1 as required by the deal.

Corzine said the process of soliciting and evaluating bids for insurers to offer the new health plans took longer than expected.Corzine may be slow with getting the job done, but he really knows how to drive a hard bargain. The negotiated price for the three month delay is totally free retiree health insurance and a wellness program. Keep this in mind when Corzine sells the Turnpike and Parkway as a down payment on the state’s obligation to public employees. Taxes will have to be raised 24 percent to pay for the rest.

In the meantime, New Jersey’s public employee payrolls continue to swell with more workers being added to the burden. In the past year, the state has added 1,000 workers and local governments have added 5,000.

The question remains, will this sorry situation have any impact on this fall’s elections?

The question remains, will this sorry situation have any impact on this fall’s elections?Labels: Election 2007, New Jersey, State Budget 2008, State Worker Benefits, State Worker Union Contract

Buyout Offers Backfire

Roberto is back to blogging on DynamoBuzz, so be sure to put him on your daily read list.

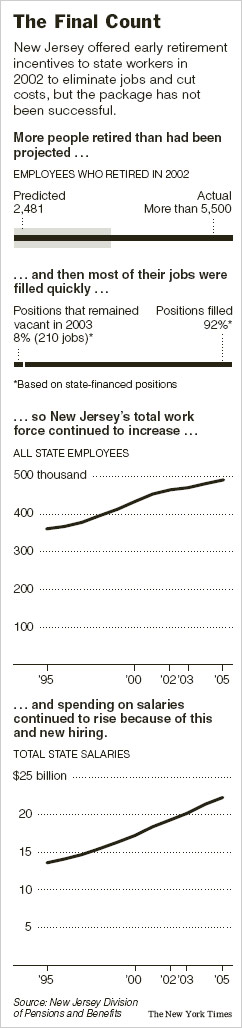

Roberto is back to blogging on DynamoBuzz, so be sure to put him on your daily read list.Today, he’s writing about a couple of New Jersey issues appearing in the New York Times, including the one about the 5,500 state workers Governor Jim McGreevey laid off with buyout packages that have come back to haunt taxpayers. As have the workers who were immediately hired to take their place.

The facts about this debacle can be found in the Times graphic to the left and commentary from Roberto.

Some people refuse to learn. Facing Gap in Budget, Newark Plans Buyout Offers.

Labels: New Jersey, New Jersey blogs, State Budget 2008, State Worker Benefits

Democrats Agree On State Budget, Ignore Republicans

Republicans had hoped Democrats would consider their recommendations for more than $1.5 billion in spending reductions, but were not given any consideration. Instead, Democrats have decided to spend $200 million more than Corzine’s original budget proposal.

Twenty-six percent of the budget will be spent on running the state and delivering services. The remaining 74 percent, about $25 billion, will be distributed to favored constituencies.

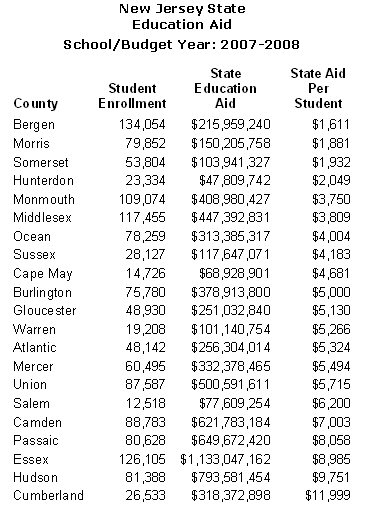

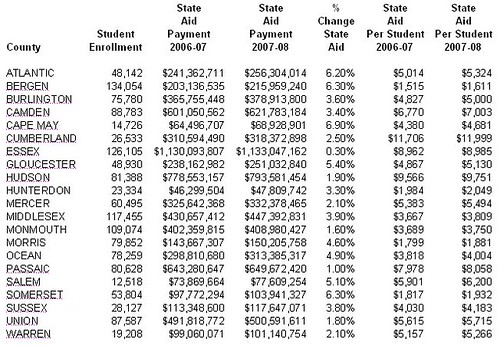

Here’s how Democrats have decided to allocate state aid for public schools for the coming school year. As you can see from the chart below, state aid will vary wildly by county – from a low of $1,611 to a high of $11,999 per student. Bergen, Morris, Somerset counties are the big losers, receiving less than $2,000 in state aid per student. Hunterdon County doesn’t fair much better at $2.049.

Labels: New Jersey, Property Tax Relief, School Funding, State Budget 2008

The War On New Jersey’s Taxpayers

Republicans tend to get defensive when they are accused of favoring the rich over the poor. That's class warfare, we are told. And it's just not American.Yes, let us look at the facts, beginning with Moran's premise that Republicans want to “take money from poor cities and shift it to wealthier suburbs.”

Which makes it difficult to be polite while discussing the latest Republican moves on the state budget. Because the GOP plan is crowded with efforts to take money from poor cities and shift it to wealthier suburbs.

Look at the facts.

There is no Republican plan to tax poor people and transfer the proceeds to the wealthy. There is no plan to take money from “poor cities” and shift it to wealthier suburbs. Money is taken from taxpayers and shifted to tax receivers. Under the Republican plan, “poor cites” would still receive more funding than last year, just not as much as Democrats would like.

Here’s the list of budget cuts proposed by Republicans. These cuts take into accout programs that have not produced results and the billions of taxpayer dollars “poor cites” have wasted through financial mismanagement and outright fraud.

The Republican plan is to implement spending controls and invest, as Democrats like to say, a tiny fraction of the budget in the state’s neglected suburbs to help limit the growth in property taxes.

And this may come as a shock to Moran, but not everyone who lives in the suburbs is a Wall Street tycoon, just as everyone one who lives in a city is not a pauper. Hoboken, a “poor city”, where Jon Corzine, Carla Katz and Bob Menendez hang their hat from time to time immediately comes to mind.

Times have changed - 13 Abbott school cities no longer meet the criteria established for the Abbott designation, but continue to receive huge state subsidies.

The class warrior, Moran, continues:

It would drastically cut state aid to urban schools, forcing major layoffs in the state's poorest districts.Republicans are proposing a more equitable allocation of education aid to all school districts. The 31 Abbott towns have been spending without regard to state taxpayers and the children in New Jersey’s other 535 municipalities.

Most of that money would be redirected to growing suburban schools on a per-student basis, with no regard to the district's level of wealth.

It’s no exaggeration to say Abbott school spending is completely out of control with Asbury Park spending $23,572 per student and the state’s largest school district, Newark, $21,503. Most of that Abbott funding comes from the state’s income taxpayers unlike the funding for New Jersey’s non-Abbott school districts which spend an average of $11,056 per student.

The so-called “poor Abbott school districts” spend far more per pupil than the state’s wealthy school districts and have been doing so since 1997. To quote what Corzine administration officials told the New Jersey Supreme Court:

Abbott districts have been spending at some of the highest levels in the State, and well beyond non-Abbott districts, with no discernable correlation to improved achievement.As for forcing major layoffs in the state's “poorest school districts”, it’s good to see Moran understands where the bulk of all that extra funding has been spent – on superfluous jobs that have contributed nothing to student achievement.

Of the 25 highest spending K-12 districts, 17 are Abbott districts. Moreover, the three highest spending K-12 districts in the State are Abbott districts.

The Abbott districts have not been required to exercise the fiscal discipline that the State and other school districts must undergo; instead they have been allowed to balance their budget through virtually unlimited supplemental funding requests.

Moran soldiers on:

It would kill a big tax cut proposed by Gov. Jon Corzine for the working poor.Republicans oppose the measure because it isn’t a tax cut. Corzine’s plan would provide a refundable tax credit, meaning that qualifying tax filers would receive a refund check greater than the amount of state income tax they paid. It would reduce the “property tax relief fund” by $64 million.

So why is this the only tax cut in the world that Republicans in Trenton now oppose? Could it be because it is aimed exclusively at working families earning less than $38,000 a year, who tend to favor Democrats?

It’s one thing to eliminate state income taxes for those earning less than $38,000 and quite another to provide people with a subsidy from the state’s school aid fund. It’s not a tax cut, it’s a grant.

Moran fights any defense of taxpayers:

The political calculus behind this is pretty simple. Republicans are giving up on winning elections in the cities -- which makes tactical sense, since they don't have much of a prayer in that fight anyway.How about we just say Republicans are going after the vote of taxpayers regardless of where they live. It’s about time.

They are going for the swing districts in the suburbs. Places like Monmouth County, where Democratic Sen. Ellen Karcher faces a tough re-election fight, and Gloucester County, where Democratic Sen. Steve Sweeney is a target.

Moran goes for the kill:

So which side, in the end, is really waging class warfare?Democrats and their tax receiving backers comprising all economic classes, that’s who. It is Democrats who have made war on the taxpaying class - raiding their incomes, savings and property. The people who pay the bills in this state are sick and tied of being portrayed as the bad guys while being treated like an ATM account with an unlimited balance.

Putting the brakes on wasteful state spending isn’t class warfare it’s called good government. Pretending the poor in New Jersey are somehow being shortchanged by taxpayers is demagoguery.

Labels: Election 2007, New Jersey, State Budget 2008, Tom Moran

Strangling New Jersey’s Taxpayers Day By Day

More than 300 days later, Corzine still hasn’t touched the pile of ideas to reduce state spending. New Jersey’s state budget has gone from $27.4 billion in 2006 to Corzine’s proposed $33.3 billion budget for 2008. That’s an 18 percent increase in state spending in just two years.

Earlier this year the governor said, “I didn’t run for public office to be a number cruncher, or to play scrooge”. Which is slightly different from the line he used when running for governor – “As a former businessman, Corzine has never seen a budget he couldn’t cut – and that experience will allow him to scrub the state budget, line-by-line.”

It’s been 809 days since we wrote:

Senator Corzine would have you believe his wealth puts him beyond the reach of special interest groups. But Jon Corzine can’t afford to alienate state workers if he hopes to become the next Governor of New Jersey. Corzine will buy the votes of government employees, not with his money, but with yours. A candidate in the pocket of teachers and other state workers can not bring real reform and fiscal sanity to Trenton.We were right. State workers are now crowing about the best deal they’ve negotiated in 15 years and for good reason. No layoffs and Corzine has rewarded state employees with a new budget busting contract that tightens their stranglehold on New Jersey’s taxpayers.

So where’s New Jersey’s legislature on this? It’s been a mighty quite budget season since the Democrats announced their own vote buying scheme.

Labels: Democrats, Jon Corzine, Legislature, New Jersey, State Budget 2008, State Worker Union Contract

New Jersey’s Pension Funding Crisis

The shortfall developed since 2001, as the collapse of the stock market drained $22 billion from the funds. Lawmakers compounded the problem by using accounting gimmicks to skip required annual payments into the funds and to cover billions of dollars in additional costs from increased retirement benefits they granted to public employees.The Ledger fails to mention two other major factors driving up the state’s pension costs – the number of active public employees added to the pension rolls and the salary increases granted to state and local government workers.

The number of active employees added to New Jersey’s pension plans increased by 41,000 from July, 2001 to July, 2005, according to the latest audited enrollment numbers available from the state. New Jersey’s public workforce has continued to grow by the thousands from that point until today.

In addition to adding more employees, increasing salaries upon which pensions are calculated has further exacerbated the funding crisis. State and local public employees have been granted incremental salary raises on top of wage scale increases that greatly out pace inflation and far exceed the average raises received by employees in the private sector. Taxpayer income and state revenue haven’t kept up with these escalating public employee payroll costs, including pension obligations.

Making matters worse, Governor Jon Corzine has recently offered state workers a salary package that will provide the average employee with a 35 percent increase in salary over the next four years - 13.6 percent in wage scale increases, the balance in incremental salary increases.

The so-called “give backs” in the contract, a 1.5 percent of salary contribution for healthcare benefits and a 0.5 percent increase in employee contributions for pension, are more than covered by with the 13.6 wage scale increases in the new agreement. Raising the retirement age from 55 to 60 for new hires will “save” peanuts, $77.3 million per year by 2022.

As the Star-Ledger points out, lawmakers also unilaterally enhanced pension benefits without a means to actually pay for the increased costs. In July of 2001, completely outside of the union contract negotiation process, the legislature recklessly granted a huge 9 percent increase in pension benefits and lowered the retirement age, effective October 1, 2001.

The state’s pension funds certainly took a hit when the stock market (DJIA) went from, a then all-time high of, 11,722.98 on January 14, 2000 to 10,593.72 on July 1, 2001 and finally, to a five-year low of 7,286.27 on October 9, 2002. But has the state invested its pension funds so poorly that little of that reported $22 billion loss was regained as the market began its climb back to record highs? The market closed yesterday at 12,530.05.

Using accounting gimmicks to skip necessary state payments into the pension funds certainly didn’t help matters, but state contributions are in addition to employee contributions and fund investment gains. How many billions would taxpayers have needed to contribute since 2001, when the pension plans were fully funded, though 2007 in order to close a $25 billion to $56 billion funding gap?

Assuming the state’s estimated investment return rate of 8.25 percent, New Jersey taxpayers should have been contributing about $3 billion every year beginning in 2002 to close a $25 billion gap and about $7.1 billion annually if the pension fund deficit is $56 billion. And that’s just to pay for pensions – the state’s obligation for retiree healthcare benefits is now estimated to be $78 billion.

State officials should have been honestly stating pension obligations and making necessary pension fund payments. Had that happened, perhaps tens of thousands of additional public workers wouldn’t have bee hired, salary increases wouldn’t have been so extravagant, healthcare and other fringe benefits would have been scaled back to a sustainable level, retirement ages wouldn’t have been lowered and pension benefits wouldn’t have been increased.

Now we all know the extent of the problem and we know the cause. It should be obvious to everyone, taxpayers can’t afford the spending binge New Jersey’s politicians have been on since 2002. Lawmakers got us into this mess and it’s within their power to clean it up. Not with more tax increases and hocking state assets, but with meaningful public employee headcount, salary and benefit cuts. That’s only solution and every politician knows it now, if they weren’t aware of it before.

Our elected officials have a choice to make and so will voters come this November. Let your representatives know where you stand!

Labels: New Jersey, Pension Funding, Public Employees, State Budget 2008, State Worker Benefits, State Worker Union Contract

The Can’t Lose New Jersey State Worker Contract

Yesterday, we explained how the “major concession” on health insurance benefits was actually another Corzine giveaway to the unions. Some employees, those enrolled in the NJ Plus medical insurance plan, will have to start contributing towards their health insurance. Workers currently enrolled in the state’s indemnity (Traditional) and HMOs plans already make contributions. Now all workers accepting health insurance from the state will pay 1.5 percent of their salary for medical benefits. Where’s the concession?

As we’ve explained before, state workers are “contributing” towards their benefits with the extra money the state’s giving them in four straight years of wage scale increases. As the union explained to state workers, “We made them raise the overall wage package in order to pay for the 1.5 percent cost.” The wage scale increases of 3 percent in each of the first two years and 3.5 percent in both of the final two years of the contract more than covers the new employee contribution requirements.

Still, there are state workers who feel this is a bad deal for them, especially in the long run because of the precedent setting health insurance contribution. They fear future increases to employee contributions for medical benefits in subsequent contracts. They fail to realize the 13.6 percent wage scale increases are locked in forever and there’s no way they lose in the long run with this new contract.

Let’s look at several scenarios to prove our point – it’s better for state employees to take the offered wage scale increases (across-the-board raises) now and contribute toward health insurance. In the short and long run, the state worker comes out ahead even if he never receives another salary increase and the state ratchets up the percent of salary for medical coverage in future contracts.

The following scenarios use the average salary for a New Jersey state worker of $54,742 for 2006. To make things less complicated, we’ll also assume the employee is at the maximum salary for his position and not eligible for any incremental salary increases - ever.

Scenario #1

He receives no across-the-board salary increases, but he never contributes towards his health insurance. He retires in 2050.

He will have earned a total of $2,408,648.00 and contributed a total of $0 for health insurance from 2007 through 2050. His net total salary is $2,408,648.00.

Scenario #2

He receives the across-the-board salary increases per the 2007-2010 contract of 3%.3%, 3.5% and 3.5% and pays 1.5 percent of his salary for health benefits. He never receives a salary increase of any type for the rest of his working years. He retires in 2050.

He will have earned a total of $2,725,552.23 and contributed a total of $40,883.28 for health insurance from 2007 through 2050. His net total salary is $2,684,668.94.

The employee is ahead by $276,020.94 under Scenario #2.

Scenario #2a

In the 2011-2014 contract he’s forced to start paying 3 percent of his salary for health insurance and there are no across-the-board salary increases. No incremental raises either.

He will have earned a total of $2,725,552.23 and contributed a total of $78,210.63 for health insurance from 2007 through 2050. His net total salary is. $2,647,341.60.

The employee is ahead by $238,693.60 under Scenario #2a.

Scenario #2b

Under the 2015-2018 contract he has to start paying 6 percent of his salary for health insurance. Still no raise.

He will have earned a total of $2,725,552.23 and contributed a total of $145,399.85 for health insurance from 2007 through 2050. His net total salary is $2,580,152.38.

The employee is ahead by $171,504.38 under Scenario #2b.

Scenario #2c

It’s now the 2019-2022 contract and it’s still bad news for our employee – no salary increase and he’s forced to start paying 9 percent of his salary for health insurance.

He will have earned a total of $2,725,552.23 and contributed a total of $205,123.60 for health insurance from 2007 through 2050. His net total salary is $2,520,428.63.

The employee is ahead by $111,780.63 under Scenario #2c.

Scenario #2d

We’re now in the 2023-2026 contract and still no salary increase. He now has to start paying 12 percent of his salary for health insurance.

He will have earned a total of $2,725,552.23 and contributed a total of $257,381.88 for health insurance from 2007 through 2050. His net total salary is $2,468,170.35.

The employee is ahead by $59,522.35 under Scenario #2d.

Scenario #2e

It’s now been 20 years and the 2027-2030 contract is not good to our employee. Still no salary increase and he has to start paying 15 percent of his salary for health insurance.

He will have earned a total of $2,725,552.23 and contributed a total of $302,174.69 for health insurance from 2007 through 2050. His net total salary is $2,423,377.54.

The employee is ahead by $14,729.54 under Scenario #2e.

Even under these worst case scenarios, no salary increase for 40 years and health insurance contributions rising to 15 percent of salary, the employee is still be ahead of the game. We all know this won’t happen. Between now and 2050 most state workers will receive incremental salary raises and additional wage scale increases in future contracts. There is no way for a state worker to lose under this new contract. Taxpayers are another story.

Labels: Health Insurance, Jon Corzine, New Jersey, State Budget, State Budget 2008, State Worker Benefits, State Worker Union Contract

New Jersey State Union Worker Contact: Health Care Insurance – Another Giveaway

Would it help make up you mind if you knew your employer’s annual contribution to your health insurance was currently $13,992 and likely would be $22,814 in four years?

That’s the deal Governor Jon Corzine has negotiated with New Jersey’s state worker unions. It’s also the deal the state’s taxpayers are expected to swallow and like it.

Here are the details. Currently, New Jersey offers three types of medical plans to state employees– an indemnity plan (Traditional Plan), Health Maintenance Organization plans (HMOs) and the NJ PLUS plan, a blend of HMO and indemnity coverage. The contact will offer one less choice to active employees.

Under the new union contract, the state’s Traditional and NJ Plus plans will be eliminated and replaced with a hybrid of the two, keeping the best features of each plan. Employees will have the option of remaining in an HMO and those with 25 years of service before July 1, 2007 can still choose the Traditional Plan when they retire.

As the union tells it members, “we have negotiated a better health plan than the one we had”. They are right. Here’s a comparison of all health insurance plans currently offered by the state and the union’s explanation of the new hybrid plan.

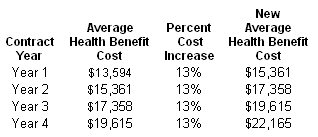

So, from the state employee’s perspective, what’s not to like about the contract’s health insurance provisions? Some employees, for the first time, will have to contribute toward their medical coverage - 1.5 percent of their salary. But for some employees, those already contributing, their payroll deductions will be considerably less. Regardless, all employees will be a get a 3 percent raise in each of the first two years and a 3.5 percent raise in the final two years of the contract. That’s on top of regular incremental salary increases, providing the average worker with a 35 percent salary increase over the course of the four-year union deal.

Currently, the annual employee contribution for family coverage is $614 for an HMO, $5,335 for the indemnity plan (Traditional) and $0 for NJ Plus. Next year, the average employee will pay $817 for either an HMO or the new hybrid plan. (Average state worker annual salary of $54,742 x 1.5 percent). In the final year of the contract he’ll be paying $1,109 – 1.5 percent of his $73,902 salary.

That average employee previously enrolled in the Traditional plan will save $4,518 in employee contributions in the first year. If enrolled in an HMO, he’ll see a small annual increase of $203 and if formerly enrolled in NJ Plus, an increase of $817.

The contract’s first-year 3 percent increase more than covers the 1.5 percent employee contribution – forever. And, employee contributions will be before tax. As the union put it - “That means that in net money, the money you get in your check, the cost of healthcare will be about 1%”.

The state currently pays $13,992 for NJ plus family coverage, including prescription drugs, and has yet to put a price tag on the new hybrid plan. We know the new hybrid plan will be better and that unlike NJ Plus, will offer a medical network in all 50 states and eliminate the need for a primary care physician referral to see a specialist.

The state’s cost certainly won’t be going down. The Benefit Review Task Force estimated active employee health insurance benefits would increase 13 percent annually though 2010. That would bring the average annual cost for the new plan to $22,814 at the end of the four-year union contact.

What a deal. If you’re a state worker you’d be a fool not to accept this contract, no matter what Carla Katz might tell you. If you’re a taxpayer, you’d be a fool to think Jon Corzine had you in mind when he offered up his latest gift to his union pals.

Labels: Health Insurance, Jon Corzine, New Jersey, State Budget, State Budget 2008, State Worker Benefits, State Worker Union Contract

New Jersey State Workers To Get Average 35 Percent Salary Increase Over Four Year Union Contract

The average state worker currently makes an annual salary of $54,742. That average worker will be getting $73,902 in pay when the union contract expires in 2010.

It’s been fifteen years, back when Jim Florio was governor, since the union won wage scale increases for every year of a contract. This is the price taxpayers have to bear so that Governor Corzine could reach an agreement in time for his unveiling of the state’s budget in February. The union crows, “We said that we believed the Governor was motivated to get a contract early and that it would work for us”. Boy, did it!

More details about the salary concessions Governor Corzine made to the unions, with examples:

The contract provides an across the board salary increase every year for the next four years. Every worker, regardless of performance, will get a 3 percent raise in each of the first two years and a 3.5 percent raise in the final two years.

The contract also preserves incremental salary increases for all workers receiving a “satisfactory” performance rating and who have not reached the maximum salary level for their position. According to the union, 70 percent of workers will be receiving these incremental salary increases every year for the next four years.

For example, a worker in a pay grade 25 position, currently earning $52,901.32 annually will have receive a $71,380.30 salary in four years. A worker currently earning the maximum of $75,194.05 in a pay grade 25 job will be making $85.445.20 when the contract expires in 2010.

Labels: Jon Corzine, New Jersey, State Budget 2008, State Worker Union Contract

New Jersey’s Unequal Aid To Municipalities

As with state aid to schools, municipal aid reduces the amount local government must fund through property taxes. However, both forms of aid vary greatly by municipality, whether viewed in terms of per student or per resident.

As required by law, each Legislative Distinct (LD) has approximately the same number of residents, and yet proposed municipal aid ranges from a low of $23,625,299 in LD-24 to a high of $119,422,814 in LD-29. The proposed average municipal aid per Legislative Distinct is $43,178,397.

Proposed state aid for each municipality and Legislative District can be viewed here and New Jersey population statistics as of December, 2006 can be found here.

The municipal aid figures in the state’s report noted above do not include all forms of state municipal aid - extraordinary aid, special aid, “Christmas Tree” and community development grants, etc.

Extraordinary aid is a budgeted amount “set aside to help towns with unexpected problems such as emergency costs or the loss of a major taxpayer”. Corzine’s budget proposes cutting Extraordinary aid by $18 million, from $43 million to $25 million. Municipalities receiving these funds will be determined later in the year.

Corzine has proposed a $37.3 million increase in Special aid, from $94.7 million to $132 million in the 2008 budget. This special aid will be granted to "distressed” municipalities that will be identified at a later date.

“Christmas tree” grants are not contained in the budget and are added by the state’s legislature “under a largely secretive process”. The governor has the authority to eliminate or approve them when signing the budget legislation. Spending on this form of municipal aid had more than doubled in the past five years, to $378 million last year.

The practice is shrouded in secrecy, and often happens in the early hours of the morning as a constitutional deadline for a balanced budget nears. Lawmakers offer no public reasons or justifications for the extra money.Given the ongoing criminal investigation surrounding the awarding of “Christmas Tree” grants, there’s a high probability that this form of municipal aid will be greatly reduced in the next fiscal year.

Legislators seeking these grants must pass through the governor's office to seek support from the person who must ultimately approve the budget.

"Christmas trees this year will go from the Christmas tree in Rockefeller Center to the Peanuts' Christmas tree," Senate President Dick Codey said. The proposed $33.3 billion budget should be more than enough to keep those special interest stockings stuffed.

Labels: Municipal Aid, New Jersey, Property Tax Relief, Property Taxes, School Funding, State Aid for Schools, State Budget 2008

New Jersey’s Disparate State Aid To Public Schools

This Budget provides $92.6 million for a 3% increase in state aid to non-Abbott districts in order to recognize the financial hardship caused by years of limited or no state aid increases.That amounts to an average increase in state aid of $86.22 per student * to the non-Abbott school districts. A few other facts jumped out at us as we reviewed the state aid numbers. There are 77 non-Abbott districts slated to receive less than $20,000 in additional state funding. That’s less than the Newark school district spends for just one student – $21,503 **.

Reviewed at the county level (chart below) you can see how just how uneven school aid is distributed. Bergen County would receive an average of $1,611 per student, the least amount in aid to any New Jersey county, followed by Morris County with $1,881 and Somerset County at $1,932 per student.

Reviewed at the school district level the state aid picture is even more disparate. For example, the proposed state aid average for Bergen County is $1,611 per student, but ranges from a low of $146 per student in Saddle River Boro to a high of $9,209 in Garfield City.

The proposed Essex County state aid average is $8,985. The Newark school district is slated to receive $16,556 in state aid per student and that’s assuming the legislature goes along with Corzine’s recommended funding cut to the district. Fairfield Township is to get $743 per student, reflecting a 3 percent increase.

The recommended average aid per student is $3,750 for Monmouth County. But again, averages can be a bit deceiving. Asbury Park would receive $21,779 per student, assuming the legislature approves the Governor’s requested reduction in school aid for the district. Deal Boro would receive $570 per student, assuming the school district’s aid is increased by 3 percent as proposed.

For more information, you can view proposed state aid by school district and by county at this link. To figure out state aid per student for a school district or county you can use these enrollment statistics from the New Jersey Department of Education at this link. [Note: The school aid figures don’t include federal funding and also excludes other forms of state school aid - debt service aid, HELP aid, and Abbott bordered district aid.]

** Newark school district budget of $900 million, divided by an enrollment of 41,855 equals an average cost per student of $21,503.

Labels: New Jersey, Property Tax Relief, Property Taxes, School Funding, State Aid for Schools, State Budget 2008

Governor Corzine Negotiating Taxpayers Into a Trap Of Higher Taxes

“Corzine said he would endorse pending legislation to "ensure there will be no premium sharing for retirees now or in the future," the New Jersey Education Association said in a message to members last week.”

Since 2002, the cost for New Jersey’s public employees’ health insurance has been increasing by double digit percentages. In 2002, retired public worker health insurance cost taxpayers $50.8 million. According to the state’s Benefits Review Task Force that number will be $2.3 billion in 2010.

“Gov. Jon Corzine, who highlighted the staggering tab for the medical benefits promised to retired public employees in his budget speech last week, has pledged that retired teachers won't have to help pay their $53.6 billion share of the bill.”

“The post-retirement medical benefits promised to 325,000 working and retired teachers are scheduled to cost the state $53.6 billion, a recent accounting report showed. That's about two-thirds of the $78 billion bill that taxpayers face for the retirement health benefits for all public employees.”

“The promise was worked by Corzine in a side deal with the state teachers' union this month while he hammered out a separate four-year collective bargaining agreement with state workers.”

“Corzine said the proposed guarantee of free retirement coverage for teachers simply continues the existing system, and would apply only to teachers already on the payroll or retired. For future hires, he said, local school boards can negotiate post-retirement insurance payments in contract talks.”

This pending legislation on retiree health insurance would tie the hands of all future governors, just as legislation to hike public employee pensions by 9 percent did in 2001. Corzine’s deal would “simply” lock in an existing system that has produced a crushing tax burden that will only get worse in New Jersey as time goes by.

Stop this “pending legislation” NOW!

Labels: New Jersey, State Budget, State Budget 2008, State Worker Benefits, State Worker Union Contract

New Jersey State Worker Union Contact

Under the new four year union contract, workers are to receive a 3 percent salary increase in years 1 and 2 and a 3.5 percent increase in years 2 and 4. Each year state employees will contribute 1.5 percent of their salary for health and 0.5 percent of salary for pension benefits.

The new contract will result in an 11 percent net increase in wages over the four year period. Using the average salary for a New Jersey State worker in 2006 of $54,742 we have the following example:

Average State Worker Salary

Under New Union Contract

Health benefits for active employees are estimated to increase 13 percent annually for the next four years, an increase of 63 percent. (Total health benefit costs for active and retired employees will increase 18 percent annually) Using the average health benefit cost for an active state worker in 2006 of $13,594 we have the following example:

Average State Worker Health Benefit

Under New Union Contract

We will address the pension issue in a separate post.

Labels: New Jersey, State Budget, State Budget 2008, State Worker Benefits, Union Contract

Funding For Corzine’s Universal Health Care Plan

Let’s see, $15 million divided by 776,000 comes to $19.33 per person.Twenty-one months later and now Governor Corzine says we have to hock the Turnpike to pay for his plan to cover New Jersey’s uninsured.

The one option that is new and that we are now studying is asset monetization.Call us skeptical about Corzine’s latest cost estimate. New Jersey covers 612,520 residents through Medicaid at a total cost of over $7 billion – the cost evenly split between state and federal taxpayers.

The economic potential from restructuring the state’s interest in our asset portfolio is too significant to ignore whether that asset is the Turnpike, the lottery, naming rights, air rights, or whatever.

Potentially, asset monetization could reset the state’s finances by dramatically reducing our debt burden, and consequently reducing debt service.

Monetization could free up as much as a billion dollars or more in every year's budget – long into the future.

The debt service payments made every year could more than fund the universal health care initiative that I’m working on with Senator Vitale.

For those who are willing to buy Corzine’s plan, we hear he has a bridge in Brooklyn he’d like to sell you.

Labels: New Jersey, State Budget 2008, Universal Health Care Plan

New Jersey State Budget 2008

Corzine’s 2008 budget calls for a 7.2 increase in spending, from $31.061billion in 2007 to $33.292 billion for 2008.

Corzine estimates state revenue from taxes and fess will generate $31.952 billion in 2008 - $1.34 billion less than his proposed spending for the year. This budget gap is to be financed with $665 million from the non-recurring use of the dedicated FY 2007 half penny from the sales tax increase and a $670 million non-recurring surplus as a result of stronger than anticipated FY 2007 revenues.

Corzine estimates a $2.5 billion budget deficit for 2009 - with state spending of $35.4 billion and revenues of $32.9 billion.

Labels: New Jersey, State Budget, State Budget 2008