Lunching Ladies and Property Taxes

The boat, it appeared, did not talk back. He didn't seem to mind.”

The opening lines of a fictional short story? No, the lede to a “news” article in the Star-Ledger.

Please. Are we to believe the intrepid reporter Judy Peet asked the lunching ladies how much they paid for their haircuts? Or that this conversation occurred within her earshot?

"That's what I mean," said one casually chic woman to the other. "How can this town improve if we don't do something about people like that?"Or that someone bragged about the price of their new condo while explaining the need to get rid of the "working class white trash"?

Cottages are giving way to condos and as one new owner of a $350,000, two-bedroom unit put it: "It's time for the town to put pressure on these old clam diggers to clean up their properties or get out."“New Highlands, meet old Highlands.”

Welfare mothers live side-by-side with teachers, writers and a Rutgers paleoanthropologist.That’s the old Highlands. Who are these snobby people of the new Highlands? According to Peet, they are people who fled Manhattan after 9/11.

“Working-class town shifts from gritty to grand as wealthy move in” and stories of “class conflict” abound. Oh, and Peet mentions property taxes have increased 43 percent.

No wonder people walk around muttering to themselves.

Labels: Highlands, New Jersey, Property Taxes, Star-Ledger

Is This Fair?

A 1999 New Jersey state report on school consolidation also noted the problem.

“Our particular town [Seaside Park], for example, is paying approximately $25,000 per student, whereas another town in the district was around $4,000.In a span of seven years, Seaside Park’s payments had grown from $25,000 to $51,500 per student while the other town’s had gone from $4,000 to $5,500 per pupil. Is this fair?

Central Regional is not a one-off in New Jersey. Bob at eCache has previously written about the Lower Cape May Regional school district where “Lower Township kicks in $5,300 per student” and the “taxpayers of Cape May pay $41,200”.

Public school spending and funding are totally out of control in New Jersey. Republicans should make this the number one issue in this fall’s elections.

Labels: Election 2007, New Jersey, New Jersey Schools, Property Taxes

When Property Tax Relief Means More Spending, Higher Taxes

Local officials say those provisions mean the targeted aid will not help offset local taxes.School aid, municipal aid, property rebates and credits are designed to be “deceiving to the public”. Each new “property tax relief” program in New Jersey has produced only one result – increased spending, higher state taxes and higher property taxes.

"It is not tax relief, and that is what people might see in this," said Robert Gratz, superintendent in Hackettstown, where aid increased 5.5 percent. "People are seeing we got 5.5 percent more, when we actually didn't."

In Montclair, superintendent Frank Alvarez said the strings on about half the new state aid his town will receive could complicate the district's efforts to win community support for the upcoming school budget."We are grateful for the money, but it certainly is not the 6 percent raise for Montclair that was advertised to the world," Alvarez said. "It is deceiving to the public. Our challenge will be trying to explain this to our local constituencies in order to gain their support during this budget process."

Labels: New Jersey, Property Tax Relief, Property Taxes, State Aid for Schools

New Jersey’s Unequal Aid To Municipalities

As with state aid to schools, municipal aid reduces the amount local government must fund through property taxes. However, both forms of aid vary greatly by municipality, whether viewed in terms of per student or per resident.

As required by law, each Legislative Distinct (LD) has approximately the same number of residents, and yet proposed municipal aid ranges from a low of $23,625,299 in LD-24 to a high of $119,422,814 in LD-29. The proposed average municipal aid per Legislative Distinct is $43,178,397.

Proposed state aid for each municipality and Legislative District can be viewed here and New Jersey population statistics as of December, 2006 can be found here.

The municipal aid figures in the state’s report noted above do not include all forms of state municipal aid - extraordinary aid, special aid, “Christmas Tree” and community development grants, etc.

Extraordinary aid is a budgeted amount “set aside to help towns with unexpected problems such as emergency costs or the loss of a major taxpayer”. Corzine’s budget proposes cutting Extraordinary aid by $18 million, from $43 million to $25 million. Municipalities receiving these funds will be determined later in the year.

Corzine has proposed a $37.3 million increase in Special aid, from $94.7 million to $132 million in the 2008 budget. This special aid will be granted to "distressed” municipalities that will be identified at a later date.

“Christmas tree” grants are not contained in the budget and are added by the state’s legislature “under a largely secretive process”. The governor has the authority to eliminate or approve them when signing the budget legislation. Spending on this form of municipal aid had more than doubled in the past five years, to $378 million last year.

The practice is shrouded in secrecy, and often happens in the early hours of the morning as a constitutional deadline for a balanced budget nears. Lawmakers offer no public reasons or justifications for the extra money.Given the ongoing criminal investigation surrounding the awarding of “Christmas Tree” grants, there’s a high probability that this form of municipal aid will be greatly reduced in the next fiscal year.

Legislators seeking these grants must pass through the governor's office to seek support from the person who must ultimately approve the budget.

"Christmas trees this year will go from the Christmas tree in Rockefeller Center to the Peanuts' Christmas tree," Senate President Dick Codey said. The proposed $33.3 billion budget should be more than enough to keep those special interest stockings stuffed.

Labels: Municipal Aid, New Jersey, Property Tax Relief, Property Taxes, School Funding, State Aid for Schools, State Budget 2008

New Jersey’s Disparate State Aid To Public Schools

This Budget provides $92.6 million for a 3% increase in state aid to non-Abbott districts in order to recognize the financial hardship caused by years of limited or no state aid increases.That amounts to an average increase in state aid of $86.22 per student * to the non-Abbott school districts. A few other facts jumped out at us as we reviewed the state aid numbers. There are 77 non-Abbott districts slated to receive less than $20,000 in additional state funding. That’s less than the Newark school district spends for just one student – $21,503 **.

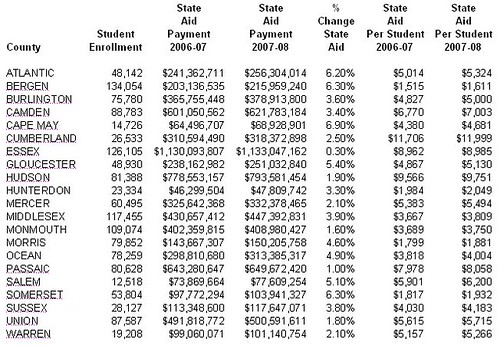

Reviewed at the county level (chart below) you can see how just how uneven school aid is distributed. Bergen County would receive an average of $1,611 per student, the least amount in aid to any New Jersey county, followed by Morris County with $1,881 and Somerset County at $1,932 per student.

Reviewed at the school district level the state aid picture is even more disparate. For example, the proposed state aid average for Bergen County is $1,611 per student, but ranges from a low of $146 per student in Saddle River Boro to a high of $9,209 in Garfield City.

The proposed Essex County state aid average is $8,985. The Newark school district is slated to receive $16,556 in state aid per student and that’s assuming the legislature goes along with Corzine’s recommended funding cut to the district. Fairfield Township is to get $743 per student, reflecting a 3 percent increase.

The recommended average aid per student is $3,750 for Monmouth County. But again, averages can be a bit deceiving. Asbury Park would receive $21,779 per student, assuming the legislature approves the Governor’s requested reduction in school aid for the district. Deal Boro would receive $570 per student, assuming the school district’s aid is increased by 3 percent as proposed.

For more information, you can view proposed state aid by school district and by county at this link. To figure out state aid per student for a school district or county you can use these enrollment statistics from the New Jersey Department of Education at this link. [Note: The school aid figures don’t include federal funding and also excludes other forms of state school aid - debt service aid, HELP aid, and Abbott bordered district aid.]

** Newark school district budget of $900 million, divided by an enrollment of 41,855 equals an average cost per student of $21,503.

Labels: New Jersey, Property Tax Relief, Property Taxes, School Funding, State Aid for Schools, State Budget 2008

Local Government Tax Shell-acking Game

Property taxpayers paid $20.9 billion of the total tab for local government, of which $15.4 billion was picked up by homeowners. State taxpayers contributed $13.3 billion and other local and state revenue sources funded the remaining $4 billion.

This means homeowners paid 40.3 percent of the cost of local government in 2006 before receiving direct property tax relief of $1.7 billion in the form of property tax rebate checks and credits. Of course state taxpayers paid for this property tax relief program too while the cost of local government remained unchanged at $38.2 billion.

The system for financing local government in New Jersey is one very complicated shell game. The object of the game is to spend as much as you dare while getting the other guy to pay for it. We’ll show you how the Local Government Tax Shell-acking game is played in future posts.

Labels: Local Government Spending, New Jersey, Property Taxes