The History of New Jersey Property Tax Relief

Contrary to popular belief, New Jersey’s income tax revenue can not be used to reduce state debt, to make contributions to state worker pension funds, to build state roads, to pay for Charity Care, to provide state security or for any other state expense. It can only be used for “property tax relief”.

The state provides “property tax relief” indirectly, by granting aid to local government (municipalities and counties) and directly, with property tax rebates/credits to homeowners and renters. Indirect “property tax relief” is granted in the form of school aid and municipal aid to local governments.

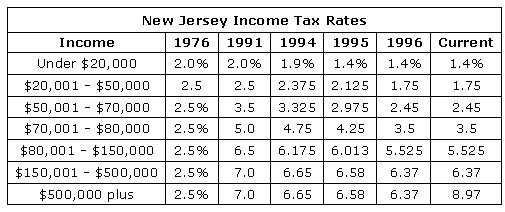

New Jersey’s Property Tax Relief Fund began working its magic under Democrat Governor Brendan Byrne in 1976 and by 1977, state income tax collections totaled $764,623,000. Initially there were two income tax brackets and rates. (see tax rate chart below).

Republican Governor Tom Kean was in office when the state income tax marked its ten-year anniversary. By 1986, the Property Tax Relief Fund had swelled to nearly three times its original size, to $2,227,740,000. The Fund grew throughout Kean’s two terms as governor without any hikes to state income rates.

But in 1991, Democrat Governor Jim Florio called for more ”property tax relief” and income tax rates were increased for “the wealthy”, people with incomes of $50,000 or more. Six income brackets were created and tax rates became more progressive (see tax rate chart below).

By the time Florio was swept from office in 1993, the Property Tax Relief Fund was at $4,325,304,000. Some New Jerseyans were beginning to catch on to the absurdity of paying more state taxes in order to have some portion of their money returned in “property tax relief”.

In 1994, newly elected Republican Governor Christie Whitman followed through on a campaign promise to reduce income tax rates over a three-year period, 1994 through 1996. As you can see from the chart below, the tax rate cuts were skewed more favorably to the lower and middle income groups, but all brackets received rate reductions.

State income tax collections increased every year the Whitman/ DiFrancesco administration was in office and by 2001, the Property Tax Relief Fund totaled $7,989,222,000, nearly double the amount when Whitman took office in 1994.

By the summer of 2004, beleaguered Democrat Governor Jim McGreevey decided more "property tax relief" was in order. He created the ”millionaires tax” and had it enacted retroactively to January 1, 2004. The “millionaires tax” amounted to the creation of a new income tax bracket and a higher rate for residents with incomes over $500,000 (see tax rate chart below).

By the time McGreevey was forced to resign from office in 2004, the Property Tax Relief Fund was pulling in $7,156,770,000, $800 million less than when the Whitman/ DiFrancesco administration left Trenton in 2001.

The reduction in the state’s income tax revenue was due to the progressive nature of New Jersey’s income tax structure. Total personal income in New Jersey had actually increased every year McGreevey was governor, but income and the number of taxpayers in the higher tax brackets had declined, therefore, state income tax revenue fell.

New Jersey households reporting over $100,000 in income account for 80 percent of the state’s income tax revenue and 42 percent of state income taxes are paid by 1 percent of filers. When taxpayers in the higher income tax brackets leave the state, lose their jobs or make less money, New Jersey’s Property Tax Relief Fund takes a nose dive.

To the good fortune of all, the “Republican-Bush tax cuts’ fueled unprecedented economic growth and by 2005, Democrat Governor Dick Codey saw state income tax revenue grow to $9,537,938,903 and by 2006 it hit $10.335,000,000. At that point, New Jersey’s Property Tax Relief Fund had grown by more than $3 billion since McGreevey’s resignation in 2004.

Enter Democrat Governor Jon Corzine who estimates the Property Tax Relief Fund will post a balance of $11.615,000,000 in 2007. That’s $1.3 billion more than last year and it may turn out to be even more. Corzine’s plan to reduce state income rates for filers with incomes of $30,000 or less, was eliminated from the new budget.

However in July 2006, Democrats decided more property tax relief was needed to counter the 40 percent rise in property taxes since their Party had taken control of state government in 2002. After much wrangling and a shut down of state government, Corzine announced a plan to raise the state’s sales tax, but to set aside some of the new revenue for “property tax relief”.

When the smoke cleared and the dust settled on New Jersey’s budget for 2007, state aid to municipalities ( “property tax relief”) remained flat, just as it had for the previous four years*. Property tax rebates were not increased as promised and some residents, lucky enough to qualify for the program, discovered their rebate will be cut $100, providing $250 in direct “property tax relief”.

Since 1976, the New Jersey Property Tax Relief Fund will have cost taxpayers $134,836,871,000 in income taxes. Billions more have been granted in "property tax releif" from the state’s other tax and revenue sources. Yet three decades later, the state still has the highest property taxes in the nation.

Of course, the only way to actually provide tax relief is to reduce spending and cut taxes. After thirty years, you’d think New Jerseyans would wise up to this fact.

We’ll see. Governor Corzine has announced he’s working on a new “property tax relief” plan and Senator Robert Menendez is calling for a repeal of the “Bush tax cuts” for the “wealthy”. Menendez apparently hasn’t discovered that for the purposes of federal tax calculations, New Jerseyans are “the wealthy”. Corzine continues to search for a new way to rob Peter to pay Paul or to just rob Peter and call it “property tax relief”.

* Thirty-one of the state’s 566 municipalities are designated as “Abbott” for the purposes of “property tax relief” related to education aid and “needy” for the purposes of “property tax relief” related to all other municipal aid. The 31 municipalities designated as “Abbott” and “needy” were not subjected to the zero growth in “property tax relief” until the 2007 budget.

Labels: New Jersey, Property Tax Relief

18 Comments:

Chart sez: NJ income tax rates have steadily gotten more steeply progressive, and the income taxes on the state-services-consumer end of the income column have significantly dropped relative to the state-services-funder end of the income column. Only in a socialist utopia, or New Jersey, would "economic justice" require that a household earning $100K pay income taxes at a tax rate nearly 14 times that of a household earning $20K.

Yeah, but you you have any facts? :-)

Quite helpful piece of writing, thanks so much for your post.

Cheap Curry One

good seller nike shoes

2016 NIKE AIR MAX

Air Max 2016 Pas Cher

zapatillas air max

2015 Air Jordan Retro

2016 Air Jordan Shoes

2015 Jordan Shoes

Odell Beckham Jr Jersey

Eli Manning Jersey

Michael Strahan Jersey

Victor Cruz Jersey

Lawrence Taylor Jersey

David Wilson Jersey

Mario Manningham Jersey

Mark Herzlich Jersey

Carl Banks Jersey

Chris Snee Jersey

Harry Carson Jersey

J.T. Thomas Jersey

Jason Pierre-Paul Jersey

Jon Beason Jersey

Landon Collins Jersey

Mark Bavaro Jersey

Owa Odighizuwa Jersey

Phil McConkey Jersey

Phil Simms Jersey

Prince Amukamara Jersey

Rueben Randle Jersey

Shane Vereen Jersey

Steve Weatherford Jersey

Will Beatty Jersey

Arizona Cardinals Jerseys

Alex Okafor Jersey

Andre Ellington Jersey

Antonio Cromartie Jersey

Bobby Massie Jersey

Calais Campbell Jersey

Carson Palmer Jersey

Chandler Catanzaro Jersey

Dan Williams Jersey

Darnell Dockett Jersey

Daryl Washington Jersey

Dave Zastudil Jersey

Deone Bucannon Jersey

Drew Butler Jersey

Drew Stanton Jersey

Eric Winston Jersey

Frostee Rucker Jersey

Jared Veldheer Jersey

Jerraud Powers Jersey

John Abraham Jersey

John Brown Jersey

John Carlson Jersey

Jonathan Cooper Jersey

Jonathan Dwyer Jersey

Atlanta Falcons Jerseys

Bear Pascoe Jersey

Brett Favre Jersey

Corey Peters Jersey

Deion Sanders Jersey

Desmond Trufant Jersey

Devin Hester Jersey

Devonta Freeman Jersey

Dezmen Southward Jersey

Drew Davis Jersey

Dwight Lowery Jersey

Gabe Carimi Jersey

Harry Douglas Jersey

Jacquizz Rodgers Jersey

Jake Matthews Jersey

Javier Arenas Jersey

Joe Hawley Jersey

Jon Asamoah Jersey

Jonathan Babineaux Jersey

Jonathan Massaquoi Jersey

Joplo Bartu Jersey

Josh Wilson Jersey

Julio Jones Jersey

Justin Blalock Jersey

Kemal Ishmael Jersey

Kroy Biermann Jersey

Justin Bethel Jersey

Kareem Martin Jersey

Kevin Minter Jersey

Kurt Warner Jersey

Larry Fitzgerald Jersey

Larry Foote Jersey

Logan Thomas Jersey

Lyle Sendlein Jersey

Matt Shaughnessy Jersey

Michael Floyd Jersey

Pat Tillman Jersey

Patrick Peterson Jersey

Paul Fanaika Jersey

Rashad Johnson Jersey

Rob Housler Jersey

Sam Acho Jersey

Ted Ginn Jersey

Ted Larsen Jersey

Tommy Kelly Jersey

Tony Jefferson Jersey

Troy Niklas Jersey

Tyrann Mathieu Jersey

Lamar Holmes Jersey

Levine Toilolo Jersey

Malliciah Goodman Jersey

Matt Bosher Jersey

Matt Bryant Jersey

Matt Ryan Jersey

Osi Umenyiora Jersey

Paul Soliai Jersey

Paul Worrilow Jersey

Peter Konz Jersey

Prince Shembo Jersey

Ra'Shede Hageman Jersey

Robert Alford Jersey

Roddy White Jersey

Ryan Schraeder Jersey

Sam Baker Jersey

Sean Weatherspoon Jersey

Steve Bartkowski Jersey

T.J. Yates Jersey

Tony Gonzalez Jersey

Tyson Jackson Jersey

William Moore Jersey

Very impressive history of property tax. There are some experts on tax i.e. Vanguard Tax Relief. I know them. They provide proper guidance and information about any tax issue. So, i think one should have proper consultation with them.

dsquared

nike shoes outlet

red bottom shoes for women

pandora

canada goose jackets

kate spade outlet

moncler outlet

moncler outlet

moncler online outlet

pandora charms outlet

qzz0719

nike shoes

nhl jerseys

chopard jewelry

ray ban sunglasses

polo ralph lauren

polo outlet

oakley sunglasses

michael kors outlet online

valentino outlet

supreme uk

I'm happy that tax system in new jersey became more progressive over the years and this trend should continue, just imagine all the osrs gold cheap you could possibly buy with the generated taxation!

I have read your articles many times and I am always inspired by your tips and knowledge. Thank you for sharing. I would love to see more updates from you.

Tax Professional

Real Time Offer: SPOT drives traffic on the fly. An example would be a slow day with only a few customers. The store manager has the ability to send out a special offer to all customers within the store’s set radius. A time and geo-sensitive SMS can bring almost immediate results. This promotion can be a specific product or a coupon for any product you offer.

Trust our experience forIRS Tax relief Long Island to help you settle your tax debts today. We can help you understand and take the necessary actions on your CP504B notice. Call today for IRS Tax relief Suffolk County.

Final Notice of Intent to Levy

The right public adjuster Long Island Hampton will offer you the services you need to make sure your insurance claim is handled the right way. Call today for water damage restoration Hamptons

frozen pipes burst insurance massapequa

Buy Madden Coins, please visit GameMS

We can provide you with the lowest price Madden coins in the entire industry. At the same time, our more than ten years of experience ensure the security of each transaction. You can safely buy in our store

Many countries consider your income tax returns as a sign of reliability and responsibility, on the basis that if you are living honestly and responsibly in your own country, you will surely do so in theirs and will not try to cheat their system out of their due income.

Tax specialist in Manchester

Post a Comment

<< Home