Explaining New Jersey Tax Increases

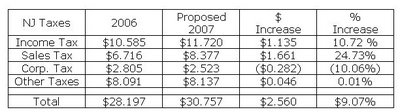

New Jersey income tax revenue will increase by 10.72 percent or $1.235 billion without any change to tax rates or laws.

The 24.73 percent increase in sales tax revenue, equal to $1.661 billion, is attributable to a 3.4 percent increase in taxes from additional retail purchases, plus a 21.33% increase in the state’s sales tax structure. Governor Corzine’s sales tax increase is achieved in two ways – extending the sales tax to previously untaxed goods and services and by increasing the sales tax rate from 6 to 7%.

Corporate taxes will actually decline by $282 million to $2.53 billion , due to previously enacted changes in New Jersey corporate tax law. However, this tax cut will be mitigated by a Corzine proposed corporate surcharge of 2.5 percent.

Corzine has proposed changes to various other taxes and fees, but revenue from these other sources remains at about a breakeven at $8.137 billion, a proposed increase of $46 million over last year.

3 Comments:

Wait, I thought it was the EvilBushyMcChimpyHalliburton Republicans who gave tax breaks to corporate types?!?!?!?!?!?

take a look at...

NJ - Tax The Crap out of You T-shirts

It is hard to believe that Corzine was once the Chairman of Goldman Sachs when he doesn't understand basic economics. If he raises sales taxes, people will buy LESS in NJ, NOT more!

Post a Comment

<< Home