Carnival of the New Jersey Bloggers # 50

Click the Graphic for More Information

One Loud, Uninformed Progressive - Hightstown Councilman Patrick Thompson

“…the extent of challenges in our community, state, and nation transcend that of yet another increase in our school taxes.”Thompson rails against federal income tax cuts “specifically for wealthy Americans” which he claims have lowered federal revenues. This is patently false. Federal revenue has increased dramatically to record highs following the tax cuts and in New Jersey alone - 3,416,000 taxpayers have benefited from the federal tax reductions.

The Councilman complains that federal expenses have skyrocketed “due not to domestic spending to make Americans smarter, safer, or more energy independent, but primarily due to poorly executed, questionably motivated foreign policy decisions.”

Thompson is obviously unaware of the facts concerning the financial resources the nation devotes to our public schools. Since 2001, the Bush administration has increased federal spending on elementary and secondary education by 41 percent. Our country is actually spending more on public schools than on national defense, devoting a total of $536 billion on k-12 education for the 2004 school year, as compared to $494 billion on national defense in 2005.

To further put things into perspective, the nation spends, adjusted for inflation, more than double per pupil today than we spent 30 years ago. And the United States spends more per k-12 student than any country in the world.

Moving his focus to the state, Thompson claims “we do not collect enough income tax revenue to adequately play the appropriate support role for our school districts” and of course he blames the “Whitman tax cuts” for property taxes increases.

Since the income tax was first enacted in 1976 have property taxes, adjusted for inflation, increased or decreased? We all know the answer - property taxes have skyrocketed, even though 100% of the state’s income tax revenue must be spent on “property tax relief”.

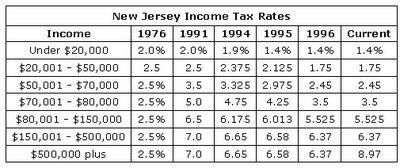

State income tax rates for those earning $50,000 or more climbed over the years as shown in the chart below. Have property taxes been reduced as state income tax rates increased or have they continued to spiral ever upwards as the state increased it’s share of taxpayer earnings? We all know the answer - property taxes have continued increasing.

As can be seen from the chart, the Whitman “30% income tax cuts” were achieved primarily by reducing the tax rates of the lower and middle income brackets – an 80% reduction in the tax rate for the lowest income earners, down to a 9% reduction on the then highest bracket of over $150,000. Perhaps Thompson could tell us how much more he’d increase the tax rate for each bracket.

As can be seen from the chart, the Whitman “30% income tax cuts” were achieved primarily by reducing the tax rates of the lower and middle income brackets – an 80% reduction in the tax rate for the lowest income earners, down to a 9% reduction on the then highest bracket of over $150,000. Perhaps Thompson could tell us how much more he’d increase the tax rate for each bracket.The Councilman fails to mention state income tax revenues have increased by 10% this year and are estimated to grow at a similar rate next year. He also must have missed the income tax hikes during the McGreevey/Codey years brought about through changes in the state’s tax code and the addition of a new tax bracket. Income tax hikes and growing income tax revenues have not translated into tax relief for the non-Abbott School districts.

Thompson dismisses the factor inequitable state funding plays in property taxes. “It may not seem fair that certain districts get a larger share of this state aid than others, but to suggest these schools are not in need of this funding to educate our children would be inaccurate.”

Thompson fails to explain why “OUR children even though they live on the other side of the Trenton, or Camden, or Newark city limits” require per pupil spending of $14,567, $15,091 and $15,796 respectively, as opposed to the $11,820 “rich Milburn” spends or the $10,499 his own school distinct spends.

Thompson claims it would require a “leap of faith to believe that there are school districts in the state that are over-funded.” As those who are informed know, New Jersey leads the nation with an average cost per student of $12,981 - 57% more than the national average. When some New Jersey school districts spend almost 80% more than the national average and 34% more than the state’s “wealthy” school districts, odds are some school districts in New Jersey are “over-funded.”

Thompson claims “in addition to the regressive system of taxation that has created this problem, we have failed to adequately leverage our economies of scale as municipal governments.”

The problem of high taxes has been created by ever increasing government spending, especially on education. What Thompson is looking for is for someone else to pay for the spending his neighbors have rejected. Instead he should be looking for the reasons the average person could afford their property taxes when they purchased their home and can’t today. Something’s driving up costs beyond their ability to pay and we doubt it’s because they aren’t paying more in income taxes – federal or state.

As a member of the Hightstown Borough Council it’s Thompson’s job to work with other communities to leverage economies of scale to the benefit of property taxpayers. If he’s not, shame on him – but don’t take it out on taxpayers across the state.

And, if Thompson thinks larger municipalities translate into reduced government costs, he might want to think again. The per capita cost of government for Hightstown is $2,763 and in East Windsor it’s $2,802 - as opposed to Asbury Park’s $6,076; Camden’s $5,522; Newark’s $5,197, Trenton’s $4,941 and Princeton’s $4,226.

Recent polls have indicated New Jerseyans are opposed to any state tax hikes and if taxes had to be raised, 59 percent would opt for an increase in the sales tax as opposed to an increase in the state’s income tax. By a 2 to 1 margin, they want deeper cuts in state programs rather than tax increases to balance the state’s budget.

People are looking for solutions for holding down the cost of government, not “one loud councilperson's opinion” devoid of facts.

Menendez” is Spanish for “Chutzpah"

The 'Rattled' Book Tour

Debra Galant, also known as the Barista of Bloomfield Ave, has some exciting news. She’s currently on a book tour with her novel, Rattled and St. Martin's has bought her novel-in-progress, "One God at Most," and a third book as well.

Debra Galant, also known as the Barista of Bloomfield Ave, has some exciting news. She’s currently on a book tour with her novel, Rattled and St. Martin's has bought her novel-in-progress, "One God at Most," and a third book as well.You can catch Debbie on her tour at one of the following locations:

· Thursday, April 27, Reading and book signing at the Pinelands Preservation Alliance in Southampton, NJ. 7 pm.

· Friday, April 28. "Girls Night Out" reading and reception at Chester County Book & Music, West Chester, PA. 7 pm

· Saturday, April 29, Reading and book signing at Barnes & Noble, Moorestown, NJ. 1 pm.

· Sunday, April 30, "Authorfest!" Wilkes-Barre, PA. 1:30 to 4 pm.

· Saturday, May 6. Reading and book signing at Clinton Bookshop, Clinton, NJ. 1 pm.

· Sunday, May 7. Reception, reading and signing at Gallery 51 in Montclair, NJ where you can also catch the current show, "Working Title." Noon to 3 pm.

· Monday, June 5. Reading and signing. Friendship Heights Village Center, Friendship Heights, MD. 7:30 pm.

It’s 'Déjà Vu, All Over Again - More Abbott Nonsense

In the past five years, state aid to public school districts has increased 30% and as the Governor stated in his budget proposal “almost all of the increases in state aid have gone to the Abbott districts. As a result, Abbott districts now represent 12 of the state's 15 highest spending K-12 districts.” Further, per pupil spending in the Abbott districts is 30-35% greater than a non-Abbott school counterpart in the same county.

The Abbott districts had requested a total increase of $550 million in state aid for next year according to records filed by the state. Governor Corzine has only budgeted $103 million more, so it’s back to the state Supreme Court.

"Each year, spending requests for supplemental funding have gone up exponentially in Abbott districts," the state's brief says. "However, we have not seen a corresponding increase, or even a significant increase, in educational achievement."Funding have gone up exponentially each year for the past 30 years since the New Jersey Supreme Court handed down its first Abbott decision, to be more precise. The attorneys arguing on behalf of the Abbott districts do what they always do, blame the state and demand even more money.

"To the Abbott districts, the state's application, in the tortured neologism of Yogi Berra, is 'déjà vu, all over again,'" Richard Shapiro, attorney for 16 of the Abbott communities, said in a brief he filed with the court last week.Talk about tortured logic. It’s not possible to “evaluate the success of Abbott programs” because there hasn’t been any. The state measures school and student performance in all districts. A review of the poor tests results for the Abbott districts are publicly available on the state’s school ‘report cards’ website. Some might concluded that the 30 year Abbott funding experiment has been a miserable failure, assuming the purpose was to provide students with a good education.

Both Shapiro and David Sciarra, the attorney arguing the case for the Education Law Center, say the state has reneged on promises in the past to put in place procedures to evaluate the success of Abbott programs and to help local communities justify their spending requests.

It has been a smashing success in raising income taxes and property taxes in the non-abbot districts and of course in increasing pay, benefits and the number of education jobs in New Jersey.

In court papers, Newark Superintendent Marion Bolden said the state is demanding costs be further curtailed even though state officials signed off on significant new expenses, including a teachers' contract that locked in salary increases of 5 percent to 6 percent..Is it any wonder why New Jersey is going broke?

Reflect On The Scale Of U.S. Economic Success

Barring some wholly unexpected statistical oddity, we will get another spectacular signal of the health of the American economy this Friday.

The gross domestic product figures for the first quarter are expected to show that America’s output expanded at an annual rate of about 5 per cent in real terms in the three months to the end of March. In this age of exaggerated gloom about the condition of the world, with all its imbalances, inequalities and uncertainties, it is worth pausing for a moment simply to reflect on the scale of US economic success.

Given that the United States is a $12 trillion economy, the new data mean that in the first quarter the US added to global output an amount that, if sustained at that pace for a year, would be about $600 billion — roughly the equivalent of adding one whole new Brazil or Australia to global economic activity every year, just from the incremental extra sweat and heave and click of 300 million Americans.

New Jersey Senate Budget Committee: Show Us 'Honest' Cuts

In all, Corzine presented the Legislature last month with $2.5 billion in cuts and curbs on annual spending increases.Restraining the growth in spending is not a budget cut - it’s spending more, although perhaps not as much as some may have preferred. Eliminating the funding for “one-time” expenses and then spending the “savings” on new programs is not a budget cut.

"It's clear that this budget is more than $2 billion higher than last year," the Republican leader [Leonard Lance] said. "When the governor talked about $2 billion in cuts, what he really meant was he wouldn't increase the budget by $4 billion."

This fact is being pointed out by Sen. Stephen Sweeney (D- West Deptford), a member of the Senate Budget Committee.

"I'm going to give him [Corzine] the opportunity to show us what he's cut," Sweeney said. "But it has to be an honest cut."Sweeney questioned Corzine proposed $10 million cut from the state's snow removal fund for next year, pointing out that New Jersey often runs through its snow removal budget, requiring the Legislature to appropriate the additional funds required. Corzine is also banking on shifting $330 million in costs from the state to the federal government and hopes for an additional $117 million increase in federal funding for human service programs to offset a drop in state funding.

Kushner Biggest Menendez Campaign Donor

So how will Senator Bob Menendez supporters react to this news?

U.S. Sen. Robert Menendez received at least $159,000 since 1997 from Kushner, his real estate partners and their relatives. He donated just $6,000 of that -- the amount the FEC said had been given illegally -- to charity after the developer's conviction.Charles Kushner you may remember is the major contributor to the New Jersey Democrat Party that pled guilty in 2004 to 18 federal crimes that included: making illegal campaign contributions, lying to the Federal Election Commission, tax fraud, hiring a prostitute and using videotapes to try to entrap his brother-in-law to stop him from cooperating with the Feds. Kushner was also the guy Governor Jon Corzine teamed up with to buy the New Jersey Nets basketball team. Very well connected to the state's Democrat political powers.

Kushner Cos. has been Menendez's biggest donor in the past five years. The firm is also developing a $600 million, 49-acre project on the Perth Amboy waterfront, which is in the House district Menendez represented before being appointed to the Senate in January.

Kushner was ultimately fined $508,000, the sixth-largest fine ever issued by the FEC, and served half of a two-year prison sentence before being released to a Newark halfway house in March. Soon he'll be back to business as usual.

We expect the reaction by Democrats to the Kushner - Menendez connection to be the same as we heard after the Menendez connection to the UMDNJ patronage scandal was disclosed.

The machine needs to be strengthened, not abandoned, and to say otherwise is naive. If we leave the machine behind, we close high office off to qualified people like Menendez and reserve it for the Corzines of the world.In other words, who cares - as long as the candidate is 'qualified'. Does it take special qualifications to vote for higher taxes in the Senate?

In any event, there is another choice in this year's New Jersey senate race - Tom Kean, Jr. He's against tax increases. Of course the Democrats have dug up dirt on him too. Diid you know he's named after his father? Yep, the Democrats have uncovered he's a junior and the latest - Tom Kean voted in favor of his homotown's school budget. Well, he and 3,098 other voters in Westfield voted in favor of the winning budget measure.

Remove New Jersey Attorney General Zulima Farber From Office

All people have the right to be treated with dignity and respect, to live in safe, clean and affordable housing and to walk down the street without being afraid, Farber said. "I understand your struggle and the challenge of being an immigrant," she said.Farber, as Jersey’s top law enforcement officer, is supposed to enforce the law and protect citizens and legal residents from law breakers. Clearly the Attorney General does not understand the struggle and the challenge of being a taxpayer in New Jersey, preferring to aid and abet illegal behavior than to prosecute it. New Jersey’s 300,000+ illegal aliens cost state taxpayers a minimum of $300 million to $400 million per year for public services. Taxpayers have the right to be treated with dignity and respect. Instead, we are treated with derision and contempt.

Farber said she decided to attend the rally, which has been organized by a coalition of grass-roots immigrant organizations, to make clear her view that undocumented immigrants should have an opportunity to legalize their status, and that they should not be treated as criminals.

How many laws must an illegal immigrant break before Zulima Farber considers it criminal? Entering and remaining in the country illegally, using forged documents to work, fraudulently receiving government funds, services, and goods, tax evasion and on and on. What a signal to send to the illegal aliens in the U.S. – New Jersey’s Attorney General welcomes you with open arms and a promise of affordable housing.

Zulima Farber is clearly unfit to be the Attorney General for the state of New Jersey and should be removed from office.

Carnival of the New Jersey Bloggers # 49

Click the Graphic for More Information

What Do They Have On Corzine?

In his inaugural address, Corzine vowed to fight corruption and rebuked lawmakers for neglecting their fiscal duties. But when Bryant and Sen. Sharpe James (D., Newark) cried foul, Corzine backed down the next day and essentially apologized for being too harsh.Unusual behavior wouldn’t you say? Why the need to kiss up to politicians best known for taking advantage of taxpayers and so far, just one step ahead of the law? Do you suppose Sharpe James and Wayne Bryant have something on Corzine? Let’s see, what could it be? Hmm, we did receive that email.

Corzine's meekness was on full display in his mystifying vote of confidence for State Sen. Wayne Bryant (D., Camden). Bryant is reportedly under investigation by federal authorities for allegations concerning his former cushy, $38,200-a-year consulting job at the University of Medicine and Dentistry of New Jersey. While on the payroll for doing goodness-only-knows at the school, Bryant also secured millions in state funds for UMDNJ. He's chairman of the Senate Budget and Appropriations Committee.

That porky arrangement was in perfect keeping with Bryant's view of state government. Over the years, he has enriched himself and several members of his family at the trough of taxpayer-funded jobs and contracts.

The federal probe has prompted Republican calls for Bryant to give up his powerful chairmanship. Corzine at first trod where he need not have, saying that forcing out Bryant was "premature," and that accusations are not proof of wrongdoing. Apparently that wasn't good enough for Bryant, because Corzine soon issued a follow-up statement expressing confidence in Bryant's "leadership," and "respect" for the senator.

It was an unseemly act of kissing up, especially after Bryant had declared the governor's proposed budget dead on arrival. "This is not the budget I will be voting on June 30," Bryant huffed.

You Don’t Always Get What You Pay For

One of the best suggestions to date is from a New Jersey state employee:

‘I constantly see my coworkers doing things I've never seen in private industry: sleeping at their desks, refusing to do any work, going grocery shopping during work hours, drinking beer, leaving work at noon, spending half the day on the phone conducting personal business or (worse) running a private business. The best thing to do is get rid of the union. But since that's not going to happen, fire one out of every three state employees."That’s not going to happen either, but it would be a step in the right direction. While the private sector has improved worker productivity, the state has being going in the opposite direction, doing less with more. With a state workforce of 154,700 and our local governments employing 401,000, is there any doubt who works for who?

Carnival of the New Jersey Bloggers # 48

Click the Graphic for More Information

Liz went fishing so Tillie is doing the dishing.

This is the Rahway Rd. that started it all.

You can't have a carnival without a geek.

Do you approve?

What happens when Mr Sami runs loose in the kitchen?

What can we expect?

Going to the Yankee game and nearly getting killed in the process?

A Good Friday in the 1950s.

Your mom made you a polyester leisure suit out of an Italian tablecloth?

No greater love.

What whacked New Jersey?

Budgets, Sales Tax, and a Challenge

Budget Cuts?

Creating poverty

Cross Your Fingers!

Caribbean oil, Caribbean drugs, and major players

Happy Easter

There Are No Cuts In Governor Corzine's Budget

Corzine has explained $1.63 billion of the increase with his proposed $1.1 billion payment to the state worker pension fund and his request for a $530 million increase in property tax rebates. So where is the remaining billion dollars in additional spending going? It’s being spent on the Governor’s priorities.

For example, the Governor has eliminated $1.9 million in funding for a program called Governor’s school. He could have saved the program by paying for it with the $2.525 million set aside in last year’s budget for public financing of the gubernatorial general election which obviously need not be funded this year. Instead, Corzine has chosen to use the combined savings of $4.8 million for other purposes.

Contrary to what some may like us to believe, Governor Corzine's budget plan does not propose a $53 million reduction in spending on state jobs. His budget proposes a $541.795 million increase in spending on state jobs. (Budget in Brief - Page 78) The Governor claims this spending increase is contractual, but that’s not the case. Pay scales and benefits for state workers may be contractual, but the number of people the state employs is not bound by contract or law. Between January 2006 and February 2006, New Jersey added 5,400 state workers to the payroll for a total state workforce of 154,700.

The Governor claims state municipal aid is ‘flat funded’ (Budget in Brief - Page 63). and special municipal aid has been reduced by $40 million. (Budget in Brief - Page 68). However, Corzine’s budget calls for $411.87 million increase in “other grants-in-aid” (Budget in Brief - Page 89).and a $21 million increase in “other state aid “(Budget in Brief - Page 89). This shows a shift in funding priorities and not a cut in spending.

So it goes throughout Corzine's budget – a small cut here and a large increase somewhere else in his budget plan In the end, Governor Corzine has funded his priorities and his priorities are costing the state’s taxpayers an additional $2.6 billion.

Democrats Call Corzine’s Budget Irresponsible

Sweeney says Governor Corzine has failed to cut spending in his proposed $30.9 billion budget which increases spending by 9.2 over last year. He also questioned Corzine’s plan to exempt 400,000 to 600,000 New Jerseyans from paying state income taxes.

"All expansions of programs need to be stopped until we see what we can do," Sweeney said. Democrats control the Assembly 47-33 and hold a 22-18 edge in the Senate; a handful of defections in the Senate could doom his spending plan.Sweeney says he doesn’t believe Corzine has the votes to pass his budget proposal and “other Democrats, speaking privately, concurred”.

Assemblyman John Burzichelli, D-Gloucester, a member of the Assembly Budget Committee, said supporting Corzine's proposed $400 million plan to expand the sales tax to include limousine rides would be easier than raising the sales tax.

A Corzine spokesman called the criticisms wrong and said lawmakers who wish to criticize the budget need to propose realistic solutions.Corzine has not proposed significant cuts in spending or we would have heard about them by now and as Jim at Parkway Rest Stop pointed out, a 16.67% increase in the sales tax is not exactly what most people would refer to as ‘modest’. Republican lawmakers have come up with at least $1 billion in proposed spending cuts and now it looks as though the Democrats may join the effort. It’s about time.

Corzine "took no joy in proposing a budget with significant cuts in spending and proposing a modest sales tax increase," said spokesman Anthony Coley.

* Sweeney referred to Corzine's proposed increase for the state pension system as $1.8 billion. Actually, Corzine is proposing to increase the pension funding by $1.1 billion and not the $1.8 billion as he originally promised during the campaign. This is probably Sweeney’s source of confusion on this subject.

Congressman Jack Kingston Conference Call

We pointed out that everyone in Washington seems to start from the premise that the country needs a guest-worker program. We asked why this notion is considered a given? Do we really need to import low-skilled workers and if the U.S. needs to import workers, how many do we need?

Kingston believes the country does need a guest-worker program, but that the actual numbers will depend on business need by industry. The Congressman cited percentages of the workforce currently comprised of illegal immigrants - agriculture 24%, cleaning industry 17%, construction 14% and food production 12 percent. This is certainly proof of employers and immigrants breaking the law, but it doesn't prove the U.S. lacks a sufficient labor pool to fill these jobs. Kingston related anecdotes from constituents telling him they couldn’t compete without hiring hard-working, but cheap illegal labor.

In relation to the various guest-worker programs being floated in Washington, we pointed out these programs were actually guest-family programs – the guest worker plus the spouse, the children and grandma. We asked how do any of these programs reduce the current number of illegal aliens in the country and going forward how would these new laws or programs help us control the flow of immigration?

Kingston described the guest-worker program he favored as one requiring the registration of all presently employed illegal aliens and the return of their non-working family members to their country of origin. From then on it would be a match between an employer and a foreign worker capable of filling the job.

We expressed doubt that family members would leave, but Kinston said if we truly want a guest-worker program than we have to get serious about only allowing just the guest-worker into the country. The Congressman did recognize the drain illegal immigrants have on local recourses, especially funds for emergency rooms and public schools, but he didn’t explain how new programs would change the present situation. The main concern seemed to be about achieving ‘clarity’ for the illegal immigrant.

For more on the immigration discussion and other topics covered on the call please see:

Captain’s Quarters

Mary Katharine Ham (HughHewitt)

Human Events Online

Right Wing News

Townhall.com’s Capitol Report

Wizbang!

Carnival of the New Jersey Bloggers # 47

Click the Graphic for More Information

Roberto atDynamoBuzz presents the Carnival of the New Jersey Bloggers #47 .

State Treasure Abelow Says New Jersey’s Budget Defies Basic Principle Of Math

In his testimony, Abelow repeated the governor’s lines – we must stop spending more than we take in and we must rely much more heavily on spending cuts than on new revenues to balance our books. He also claimed the proposed 2007 budget contained spending cuts and then said:

Common sense suggests overall spending should be flat, if not lower as compared to the current year’s budget. New Jersey’s budget, however, defies this basic principle of math.Actually, New Jersey’s budget does not defy logic or basic math principles. It’s the Governor and his spokesman’s spin that attempt to alter reality in the minds of the people of New Jersey. Proposed spending in the 2007 budget is up 9.2% and state tax revenue, before Corzine’s latest round of tax increases, has experienced tremendous growth. The New Jersey Tax and Revenue Outlook Fiscal Year 2006-2007 report, released yesterday, highlights the fact the state has a spending problem and not a revenue problem.

- New Jersey’s income tax revenue is up 11.6% year-to-date for fiscal year 2006. (Fiscal year 2004 income tax revenue revenues grew by 10%, and for fiscal year 2005, income revenue grew by 29%.)

- New Jersey’s sales tax revenue is up 3.5 % year-to-date for fiscal year 2006. (Fiscal 2004 sales tax revenue revenues grew by 5.5% and for fiscal year 2005, sales tax revenue grew by 4.6%.)

- New Jersey’s corporation business tax (CBT) revenue year-to-date is 33.7% above last year.

- New Jersey’s inheritance tax revenue is up 19% year-to-date over last year.

- New Jersey’s realty transfer revenues are up 33.4% for fiscal year 2006.

Leading The Charge To Lower The Cost Of Local Government

Corzine’s talking about going after municipalities with lower local government costs, but high property taxes. Of course he forgets to mention one reason property taxes are so high in these towns is because they receive little to almost no state aid, while the residents send an obscene amount of tax dollars to the state.

When Burlington County resident Richard Harris recommended that each county have just one school district to ease the property tax burden, Corzine said he plans to "lead the charge" for less local government.Maybe someone should tell the Governor many municipalities with high property taxes currently share services, use volunteers or require residents to make private arrangements and personally pay for a variety of services taken for granted by the bottomless money pits, such as Newark. Shared regional high schools, all volunteer fire and EMS services, and requiring homeowners to privately contract and pay for services, such as garbage disposal, are not unique in towns paying their own way. Encouraging more municipalities to adopt similar strategies is great, but that’s not where the really big bucks can be saved.

"I think we are going to have to come to grips as a society with whether we need all this fragmentation," he said. "Communities that are consolidating or sharing services, we will be more apt to grant aid in those circumstances."

[Assembly Speaker Joseph] Roberts (D-Camden) and Gov. Jon Corzine's staff are developing legislation to encourage shared services that is expected to include a "carrot and stick" approach. Legislation may call for more aid for towns or schools that develop shared service programs -- and aid cuts for those that do not act when a shared service is obvious.As Governor Corzine and Assembly Speaker Roberts are both pushing to reduce the cost of local government, we suggest they begin with a list of municipalities sucking the state dry. These are the towns currently receiving almost all of the carrots, while the rest receive a stick in the eye. If legislation is needed, it's needed to reverse state’s present carrot and stick approach.

As you can see from the chart below, the costs per homeowner for these local governments are outrageously high and the state’s taxpayers are picking up the tab for as much as 95% of the costs. How about a stick to prevent this abuse?

If you’re curious how your town compares, check out this database compiled from government records by the Star-Ledger. Fair warning - do so at your own risk, it’s enough to make you sick. You’ll find most towns have a cost per homeowner about half the cost of the lowest in the chart below.

New Jersey Municipalities with High Cost Local Governments

Kean Vs. Menendez

Something many of us have long been assuming, that a decent number voters are confusing GOP Senate candidate Tom Kean Jr with his ex-Governor father, has been confirmed by the latest Eagleton Poll from Rutgers University. Menendez leads the poll overall, with 40% to 35% for Kean Jr among registered voters. Naturally, the numbers only get better for Menendez when you filter out the voters who have their Tom Keans mixed up.We have no doubt some people may be confusing Tom Kean Jr. with his father, but an unbiased look at the poll results would lead most to conclude that the vast majority of those surveyed are confused about both Kean and Menendez.

The percentages of voters who think Tom Kean Jr served as Governor of New Jersey or was a member of the 9/11 Commission are 12% and 11%, respectively. When their preferences are removed from the results, Menendez's lead goes up to 42% to 33%. And it's not just the Kean confusion that skews the numbers. As the Eagleton press release notes, "[t]hose who were more knowledgeable about politics showed a very different pattern of responses than those who were less knowledgeable."

Here are the “knowledge questions” asked by the Eagleton Poll. The same questions were repeated to those surveyed in relation to both Kean and Menendez.

I'm going to read you a list of public offices and as I read each one, please tell me if Robert Menendez/Tom Kean Jr. now holds or has ever held this position? (Member of Congress, U.S. Senator, Member of the NJ Legislature, Governor of New Jersey)Here are the poll results with the correct responses highlighted in green.

From what you know, was Robert Menendez/Tom Kean Jr. a member of the 9-11 Commission?

In the final analysis, as our chart shows below, the vast majority of respondents didn’t have a clue - either guessing wrong or unable to answer every question with the exception of the one about Governor. On the Governor question, 26% didn’t know whether or not Menendez is or has been Governor and 35% answered similarly about Kean. But on the most relevant question, what office does each man currently hold? - 74% of the respondents didn’t know Bob Menendez is a U.S. Senator and 74% didn’t know Tom Kean Jr. is a New Jersey State Senator.

Here are our conclusions based upon the poll results:

- The majority of respondents expressed a preference for a candidate based upon being told the political party of each man.

- Right now the race is close.

- The vast majority of New Jersey voters are clueless.

New Jersey’s Public Schools Spend 57 Percent More Than National Average

New Jersey again leads the nation with an average cost per student of $12,981 - 57% more than the national average of $8,287 per pupil. For 2004, New Jersey’s property taxpayers contributed $11 billion, state income taxpayers $8.8 billion and the federal government $893.4 million towards the funding of New Jersey’s K-12 public schools.

Show Us the Money Governor Corzine

“If the Governor is going to take credit for making $2 billion in spending cuts, I think he needs to provide a detailed explanation as to what he has actually cut.”Last Tuesday we provided the complete list of budget cuts the Governor proposed and as we pointed out, the only cut was $71.81 million to institutions of higher learning and of that amount, $11.98 million was aid to private colleges. The remaining $302.92 million in so-called cuts came from the reduction or elimination of “one-time” grants.

“You can’t raise a spending account by five percent and call that a cut just because some department wanted a ten percent increase,” he added. “Only in this administration’s vocabulary can a spending increase be called a spending cut.”

This past Wednesday we provided a list of more than $800 million in additional budget cuts and did so without cutting one head from the state’s 152,700 person workforce or one penny from current state services or programs. With a few “hard choices” we could have trimmed the budget by billions.

Taxpayers should be backing Assemblyman DeCroce’s call for a detailed list of Corzine’s cuts and the media needs to do a better job of reporting the facts as opposed to regurgitating Corzine’s spin on this issue. It would also be extremely helpful if we all could agree on the meaning of the terms ‘spending cut’ and ‘spending increase’.

Contact information

Governor Jon S. Corzine:

Telephone: 609-292-6000

Email: Link to email submission form

Address: Office of the Governor - PO Box 001- Trenton, NJ 08625

New Jersey Legislature (Assembly and Senate):

Telephone and Address: Lookup for official's address and phone number

Email: Lookup for officials' email form

Carnival of the New Jersey Bloggers # 46

Click the Graphic for More Information

The Old Fox is trying to trick us., it's the Carnival of the New Jersey Bloggers #46