One Loud, Uninformed Progressive - Hightstown Councilman Patrick Thompson

“…the extent of challenges in our community, state, and nation transcend that of yet another increase in our school taxes.”Thompson rails against federal income tax cuts “specifically for wealthy Americans” which he claims have lowered federal revenues. This is patently false. Federal revenue has increased dramatically to record highs following the tax cuts and in New Jersey alone - 3,416,000 taxpayers have benefited from the federal tax reductions.

The Councilman complains that federal expenses have skyrocketed “due not to domestic spending to make Americans smarter, safer, or more energy independent, but primarily due to poorly executed, questionably motivated foreign policy decisions.”

Thompson is obviously unaware of the facts concerning the financial resources the nation devotes to our public schools. Since 2001, the Bush administration has increased federal spending on elementary and secondary education by 41 percent. Our country is actually spending more on public schools than on national defense, devoting a total of $536 billion on k-12 education for the 2004 school year, as compared to $494 billion on national defense in 2005.

To further put things into perspective, the nation spends, adjusted for inflation, more than double per pupil today than we spent 30 years ago. And the United States spends more per k-12 student than any country in the world.

Moving his focus to the state, Thompson claims “we do not collect enough income tax revenue to adequately play the appropriate support role for our school districts” and of course he blames the “Whitman tax cuts” for property taxes increases.

Since the income tax was first enacted in 1976 have property taxes, adjusted for inflation, increased or decreased? We all know the answer - property taxes have skyrocketed, even though 100% of the state’s income tax revenue must be spent on “property tax relief”.

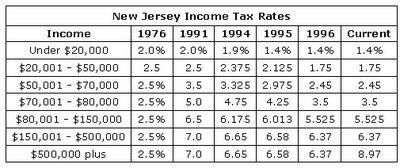

State income tax rates for those earning $50,000 or more climbed over the years as shown in the chart below. Have property taxes been reduced as state income tax rates increased or have they continued to spiral ever upwards as the state increased it’s share of taxpayer earnings? We all know the answer - property taxes have continued increasing.

As can be seen from the chart, the Whitman “30% income tax cuts” were achieved primarily by reducing the tax rates of the lower and middle income brackets – an 80% reduction in the tax rate for the lowest income earners, down to a 9% reduction on the then highest bracket of over $150,000. Perhaps Thompson could tell us how much more he’d increase the tax rate for each bracket.

As can be seen from the chart, the Whitman “30% income tax cuts” were achieved primarily by reducing the tax rates of the lower and middle income brackets – an 80% reduction in the tax rate for the lowest income earners, down to a 9% reduction on the then highest bracket of over $150,000. Perhaps Thompson could tell us how much more he’d increase the tax rate for each bracket.The Councilman fails to mention state income tax revenues have increased by 10% this year and are estimated to grow at a similar rate next year. He also must have missed the income tax hikes during the McGreevey/Codey years brought about through changes in the state’s tax code and the addition of a new tax bracket. Income tax hikes and growing income tax revenues have not translated into tax relief for the non-Abbott School districts.

Thompson dismisses the factor inequitable state funding plays in property taxes. “It may not seem fair that certain districts get a larger share of this state aid than others, but to suggest these schools are not in need of this funding to educate our children would be inaccurate.”

Thompson fails to explain why “OUR children even though they live on the other side of the Trenton, or Camden, or Newark city limits” require per pupil spending of $14,567, $15,091 and $15,796 respectively, as opposed to the $11,820 “rich Milburn” spends or the $10,499 his own school distinct spends.

Thompson claims it would require a “leap of faith to believe that there are school districts in the state that are over-funded.” As those who are informed know, New Jersey leads the nation with an average cost per student of $12,981 - 57% more than the national average. When some New Jersey school districts spend almost 80% more than the national average and 34% more than the state’s “wealthy” school districts, odds are some school districts in New Jersey are “over-funded.”

Thompson claims “in addition to the regressive system of taxation that has created this problem, we have failed to adequately leverage our economies of scale as municipal governments.”

The problem of high taxes has been created by ever increasing government spending, especially on education. What Thompson is looking for is for someone else to pay for the spending his neighbors have rejected. Instead he should be looking for the reasons the average person could afford their property taxes when they purchased their home and can’t today. Something’s driving up costs beyond their ability to pay and we doubt it’s because they aren’t paying more in income taxes – federal or state.

As a member of the Hightstown Borough Council it’s Thompson’s job to work with other communities to leverage economies of scale to the benefit of property taxpayers. If he’s not, shame on him – but don’t take it out on taxpayers across the state.

And, if Thompson thinks larger municipalities translate into reduced government costs, he might want to think again. The per capita cost of government for Hightstown is $2,763 and in East Windsor it’s $2,802 - as opposed to Asbury Park’s $6,076; Camden’s $5,522; Newark’s $5,197, Trenton’s $4,941 and Princeton’s $4,226.

Recent polls have indicated New Jerseyans are opposed to any state tax hikes and if taxes had to be raised, 59 percent would opt for an increase in the sales tax as opposed to an increase in the state’s income tax. By a 2 to 1 margin, they want deeper cuts in state programs rather than tax increases to balance the state’s budget.

People are looking for solutions for holding down the cost of government, not “one loud councilperson's opinion” devoid of facts.

7 Comments:

Nice piece.

It should be noted, that while the Bush Administration has increased federal educational spending, it has done so despite education not being a federal responsibility. Education is not a fundamental right and is therefore reserved as a state right.

If the feds closed up the federal DOE and returned those tax dollars to the cititzens, NJ could collect state taxes on that income to better fund education here in the Garden State.

The cost of running the federal DOE is the slippage.

None of that, however, provides any justification for a city government to overrule the clear mandate of its citizens.

You want a good laugh? In Guttenberg, the school budget was voted down two years in a row. As a result, Mayor David Delle Donna decided that it would be in the town's "best interest" to have a Mayor appointed board.

He hatched a "brilliant" scheme by breaking up the budget proposal into four different public questions, among them being money for new history books and a bilingual teacher, and buried the the proposal for a Mayor Appointed board all the way at the bottom making it Public Question 5.

That wasn't enough for him however. On top of that he had the question worded in a way that if you wanted to vote against a Mayor Apponted Board you had to vote yes. Is this slimy or what!?

So what was the end result? All five public questions were soundly defeated by a two to one margin. In other words, the people overwhelmingly voted no, no, no, no and YES!!!

This just goes to show that not only does Mayor Delle Donna have absolutely no respect for the intellegence of the people he serves but when overburdened taxpayers are fed up they will always take their public officials to task for it. There was no way on Earth that the Guttenberg Taxpayers were going to allow an incompitent Mayor that has taxed and spent the town through the ground get control of the School Board. Not even the candidates whom the Mayor endorsed who all won were in favor of this proposal.

This was a great victory and vindication for the people of Guttenberg and a resounding defeat for a sleazy political hack. Great story eh Enlighten!?:-)

I stand corrected. It was six public questions, so the people voted no, no, no, no, no, yes. PFFFFFFFFFFFTTTTTT! Even better!!!

So, when the headine reads "uniformed", did you mean to say "uniNformed"? Christ, you're such a dick.

Jeez enlighten ol' buddy! Looks like Councilman Thompson is REALLY bad at taking ciritcism!!;-)

Yea, it was a typo. Fixed it.

Hightstown Councilman Patrick Thompson likes to unwind by playing some punk rock with his guitar.

Post a Comment

<< Home