Goodbye 2006

2006 has not been a good year for the Enlighten-New Jersey gang. We have lost three dear ones since October so blogging just hasn’t been on our to do list. I know my heart just isn’t in it and I’m not sure it will be going forward. We’ll see.

Wednesday, December 20, 2006

Saving Businesses That Save Lives

According to Blue Jersey Ferguson Disingenuous on Part D. The blog post takes Congressman Mike Ferguson (R) to task as “a prime sponsor of the Medicare Part D prescription benefit which most folks find too expensive, confusing and problematic.” Blogger huntsu finds Ferguson to be disingenuous because one, the congressman is grateful for a drug that extended his mother’s life and two, because Ferguson opposes repeal of the provision that prevents Medicare from negotiating directly with drug companies on prescription prices.

It is not necessary to have a loved one enrolled in the Medicare prescription drug plan to be grateful for pharmaceutical companies and their employees who have researched and developed the drugs that cure, relieve suffering and extend lives.

A recent article from the Washington Post – Success of Drug Plan Challenges Democrats - refutes the left’s usual talking points on Medicare Part D. Beginning with the fact that 80 percent of the 22.5 million seniors who have enrolled in the program are satisfied and the cost has turned out to be lower than projected.

Keep up the good work Mike Ferguson!

It is not necessary to have a loved one enrolled in the Medicare prescription drug plan to be grateful for pharmaceutical companies and their employees who have researched and developed the drugs that cure, relieve suffering and extend lives.

Ferguson recently lost his mother to multiple myeloma, but not before Celegene's Revlimid allowed her three more years of life. For him, the issue is passionately personal: "Price controls of any sort not only hurt seniors," he says. "They hurt our children and grandchildren who suffer with Parkinson's, cancer and juvenile diabetes."Drug company owners – individual stockholders and pension plans – deserve a fair return on their investment for their risk. Without a profitable pharmaceutical industry the medical miracles we take for granted would not exist and Congressman Mike Ferguson can hardly be considered disingenuous for stating an economic fact.

A recent article from the Washington Post – Success of Drug Plan Challenges Democrats - refutes the left’s usual talking points on Medicare Part D. Beginning with the fact that 80 percent of the 22.5 million seniors who have enrolled in the program are satisfied and the cost has turned out to be lower than projected.

The cost of the program has been lower than expected, about $26 billion in 2006, according to the nonpartisan Congressional Budget Office. The cost was projected to rise to $45 billion next year, but Medicare has received new bids indicating that its average per-person subsidy could drop by 15 percent in 2007, to $79.90 a month.For a big government entitlement program, Medicare Part D has been more successful than anyone could have hoped.

Urban Institute President Robert D. Reischauer, a former director of the Congressional Budget Office, called that a remarkable record for a new federal program.Our guess is that the left is looking for an issue to demagogue. Some have bought into the left’s propaganda if you’ll recall the woman who believed she was a victim of the Medicare Part D program that enabled her to reduce her annual cost for prescription drugs from $10,562 to $1,620 - her annual “doughnut hole” covered drug plan premium. Her view is apparently representative of the 20 percent of enrollees dissatisfied with Medicare Part D and one the left hopes will become conventional wisdom about the program. Perpetrating this false perception is necessary in order to bring about the left’s solution to the “problem” – “greedy drug companies” must have their profits curtailed though what would amount to price controls for the common good.

Initially, he said, people were worried no private plans would participate. "Then too many plans came forward," Reischauer said. "Then people said it's going to cost a fortune. And the price came in lower than anybody thought. Then people like me said they're low-balling the prices the first year and they'll jack up the rates down the line. And, lo and behold, the prices fell again. And the reaction was, 'We've got to have the government negotiate lower prices.' At some point you have to ask: What are we looking for here?"

Medicare recipients account for half of all drug prescriptions. With that kind of clout, government might try to dictate prices, not just negotiate them. This could leave people without drugs that manufacturers decide aren't sufficiently profitable under the plan. The VA plan illustrates the point. It offers 1,300 drugs, compared with 4,300 available under Part D, prompting more than one-third of retired veterans to enroll in Medicare drug plans. Lower prices also create less incentive for research. That, though, is an issue in any attempt to control costs.Now that the election is over some responsible Democrats have decided reality can again be the basis for discussing Medicare Part D.

Rep. Fortney "Pete" Stark (D-Calif.), who is in line to become chairman of a key health subcommittee, said he prefers a middle path, with Medicare setting ceilings from which private insurers could negotiate downward.Apparently, Mike Ferguson is not alone in believing our market based system works:

But Sen. Max Baucus (D-Mont.), the incoming Senate Finance chairman, is cool to the idea of government negotiation, and has committed only to holding hearings to "determine what the result would be of eliminating" the no-negotiation clause.

The theory behind Part D is that market forces and competition among drug plans, overseen by government, can achieve better results than a government-run program. The multitude of plans allows seniors to pick one that best meets their needs. Both the non-partisan Congressional Budget Office and Medicare actuaries have said they doubt the government could negotiate lower costs than the private sector.For the sake of people throughout the world, we hope the left is thwarted in their attempt to destroy the life saving and enhancing pharmaceutical industry in the United States. We remain cautiously optimistic, although we must confess the day after the midterm elections we sold every share of stock we owned in drug companies. Living in Blue Jersey we know just how powerful the left can be and how destructive their polices are to an economy and the wellbeing of citizens.

Keep up the good work Mike Ferguson!

Thursday, December 14, 2006

Our Hearts Are Broken

God saw you getting tired,

When a cure was not to be.

So He wrapped his arms around you,

and whispered, "Come to me".

You didn't deserve what you went through,

So He gave you rest.

God's garden must be beautiful,

He only takes the best

And when I saw you sleeping,

So peaceful and free from pain

I could not wish you back

To suffer that again.

When a cure was not to be.

So He wrapped his arms around you,

and whispered, "Come to me".

You didn't deserve what you went through,

So He gave you rest.

God's garden must be beautiful,

He only takes the best

And when I saw you sleeping,

So peaceful and free from pain

I could not wish you back

To suffer that again.

Tuesday, December 05, 2006

Think Equal Benefits Act!

A couple of Blue Jersey bloggers have created ads to supposedly explain why New Jersey’s legislature should enact a gay marriage law instead of a civil union law. We have yet to hear a good reason why the state should not opt for the civil union approach - whatever law adopted will comply with the state's Supreme Court ruling requiring gay partners to be afforded the same benefits as married couples.

We also have yet to hear why the proposed Equal Benefits Act is unacceptable to the Think Equity crowd. Gay people are not the only partners facing discrimination under state law. The Act would extend the legal rights of marriage to all partners living together in financially dependent relationships and would certainly be more equitable than a law that strictly benefits gay couples. Is it fair or equitable for the state to be able to steal a shared house from a surviving sister through the state’s inheritance tax, but unfair if the two women were gay? The legislature should take this opportunity to create true equity with a civil union statute that’s fair to all.

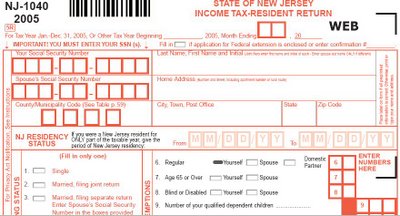

We don’t know how effective Blue Jersey’s Juan Melli and Jack Bohrer’s ad will be in convincing people to back gay marriage. Most woman and anyone familiar with New Jersey’s income tax form will find their ad’s content ridiculous. And to think the two “went into debt fronting the $4,000 production costs for the ads”.

Think Equal Benefits Act!

We also have yet to hear why the proposed Equal Benefits Act is unacceptable to the Think Equity crowd. Gay people are not the only partners facing discrimination under state law. The Act would extend the legal rights of marriage to all partners living together in financially dependent relationships and would certainly be more equitable than a law that strictly benefits gay couples. Is it fair or equitable for the state to be able to steal a shared house from a surviving sister through the state’s inheritance tax, but unfair if the two women were gay? The legislature should take this opportunity to create true equity with a civil union statute that’s fair to all.

We don’t know how effective Blue Jersey’s Juan Melli and Jack Bohrer’s ad will be in convincing people to back gay marriage. Most woman and anyone familiar with New Jersey’s income tax form will find their ad’s content ridiculous. And to think the two “went into debt fronting the $4,000 production costs for the ads”.

Against a plain, white background, two women sitting side by side personify the differences between being married and being "civil-unionized."When civil unions become law in New Jersey, all partners will have to do is check a slightly revised box that’s labeled “civil union partner” instead of the current “domestic partner” box on the state’s income tax form.

In one of the spots shot on Monday in a Brooklyn film studio on North 12th Street, the married woman is carefree with her shoes kicked off enjoying a pint of ice cream as she completes a crossword puzzle.

The woman in the civil union can't relax. She's stuck doing her income taxes – stumped on the form's marital status question because she doesn't fit any of the three choices: married, divorced or widowed.

"You should upgrade to a marriage," the married woman says.

The screen fades to show only the words, "Think Equal."

Think Equal Benefits Act!

Monday, December 04, 2006

The Farmland ‘Roll-back’ Tax - Part II

A reader emailed us about the Democrats proposed new seven-year farmland ‘roll-back’ tax. We asked if we could share his situation with our readers and he agreed. His email is posted below with his name and town removed to respect his privacy:

The Dems are proposing to change the "Roll-Back" rules on farm assessed land. Making the landowner pay back 7 years of back taxes instead of the current 3. This is bad public policy for New Jersey as it is going to lead to many thousands of acres being sold off for immediate development. Additionally, it is going to kill smaller land owners that have significant investments in blood, toil, sweat and equipment.

If you have a moment, let me explain the impact on people with smaller lots or the "rich" as the Dems are fond of saying.

I own 8 wooded acres. My 8 acres consists of 4 acres that the township decided that I can't develop or disturb the soil (no bridges over brooks or filling in gullies for trails) and yet with all these restrictions the land would get taxed at full developed land rates because of the "privacy" it affords me.

In order to get into a farmland assessment I had to show $525.00 in wood sales (cut, split and delivered firewood) for 3 years; I had to pay a certified NJ forester to produce a woodland management plan and have to pay him each year to come out and certify that I am following that plan; the tax assessor must come out and validate that I have actual activity on the land.

In order to meet these requirements I have spent at least $19,000 in capital expenses (equipment). Each and every year I have to cut down enough trees to equal 3.5 - 4 cords of wood, cut the trees into logs, split the logs, advertise my product and deliver my product. I do this on weekends. I have to report this income on my taxes and provide receipts to the tax assessor. For all this work I'll save a grand total of $1,900 this coming tax year.

So why do I do for the minor savings?

More importantly, the woods need to be managed. Managed woods allow for the culling of trees from the forest allowing the small trees to grow and the undergrowth and seedlings to grow stronger. This helps stop fire damage, provides better habitat for the little woodland critters (including bears), provides for local consumption of renewable resources, provides for clean water from my brooks that run into the south branch of the Raritan. In too many places I see woodlands that have been placed into conservation whether owned by the Government or privately being destroyed because they are not being managed.

How does the farmland assessment program help?

I use the savings from my taxes to manage the land. It pays for the forester, It helps pay for the equipment, some goes to planting new trees, some goes to preventing erosion in the stream walls and, most of all, between the minor tax savings and my sweat equity I will leave the world a small but better 8 acres.

Saturday, December 02, 2006

The Farmland ‘Roll-back’ Tax

Under the state's constitution, real estate owners can qualify for a special farmland assessment and pay reduced property taxes. Obviously if farmland was taxed at the same obscene rate as home and commercial property, rather than on its productivity value, no one could afford to use land for agricultural purposes in the Garden State. But now Democrats want to amend the state’s constitution and add new taxes on farmland as part of their “property tax relief” plan.

First, this change is completely unfair to current landowners who would see huge tax bills should they need to sell their land - a seven year roll-back tax, a tax on land owned less than seven years and a state real estate transaction tax. Second, the goal of the Special Legislative Session was to reduce property taxes, not to increase and enact new taxes. And finally, why should the state receive revenue from a roll-back tax? It is the counties and municipalities where farmland is located that have “lost out” on higher property tax assessments, not the state.

The New Jersey Farmland Assessment Act of 1964 permits farmland and woodland actively devoted to an agricultural or horticultural use to be assessed at its productivity value. The Act does not apply to buildings of any kind, nor to the land associated with the farmhouse. Buildings and homesites on farms are assessed like all other non-farm property. When and if the land qualified under the Act changes to a non-agricultural or non-horticultural use, it is subject to a roll-back tax.The roll-back tax currently equals the amount in property taxes the owner has saved because of the special assessment during the current year and previous two years. Democrats want to amend the state constitution to extend the roll-back tax to six years, plus the current year and add a new tax on farmland owned for seven years or fewer before it is sold.

To be eligible for Farmland Assessment, land actively devoted to an agricultural or horticultural use must have not less than 5 acres devoted to 1) the production of crops; 2) livestock or their products; and/or 3) forest products under a woodlot management plan.

First, this change is completely unfair to current landowners who would see huge tax bills should they need to sell their land - a seven year roll-back tax, a tax on land owned less than seven years and a state real estate transaction tax. Second, the goal of the Special Legislative Session was to reduce property taxes, not to increase and enact new taxes. And finally, why should the state receive revenue from a roll-back tax? It is the counties and municipalities where farmland is located that have “lost out” on higher property tax assessments, not the state.

"By pandering to their urban constituency, the Democrats are courting disaster for New Jersey's farmers and agriculture-related businesses," state Sen. Robert E. Littell, R-Sussex County, said in a statement.That explains it. This proposed change to farmland taxes is just one more scheme by Democrats to take money from the suburban and rural areas of the state for the benefit of the urban centers. Fairness never enters into the equation as it’s all about finding every possible angle to squeeze more money from taxpayers to give to the tax eaters – consequences be damned.

"I think it would lead to more farmers leaving farming," Senate Minority Leader Leonard Lance, R-Hunterdon/Warren counties said about the roll-back tax expansion. "I think it's a very bad idea, and I shall fight it tooth and nail."We have a better idea that’s in keeping with the purpose of the Special Legislative Session. Revise the New Jersey Farmland Assessment Act such that revenue from the three-year roll-back tax flows directly to a municipality where a farmland use change or sale occurs. That would be real property tax relief without an increase in taxes. Isn't that the point?

Both Lance and Littell cited a 1999 study by Cook College that estimated 67,780 acres of farmland would be lost under the kind of roll-back tax change recommended by the committee.

Peter Furey, executive director of the New Jersey Farm Bureau, said that loss in acres would theoretically come from farmland being prematurely withdrawn from the program and sold for development to avoid the beefed-up tax.

"Sen. Littell is bringing up some concerns that a lot of people hold about making changes to farmland assessment," Furey said. "We think it needs to be examined very carefully."