Creating An Equitable And Efficient New Jersey Property Tax Relief Program

Corzine also proposes using the state’s Property Assessment Management System (PAMS) to replace rebate checks with direct credits to each homeowner’s property tax bill by July 1, 2007.

Corzine’s original budget called for spending an additional $530 million to increase homeowner rebates and tenant credits by 10 percent. The $530 million would have increased senior homeowner rebates by a maximum of $130 and for all other homeowners by a maximum of $35. Senior tenant credits would have increased by a maximum of $82 and all other tenant credits by $7.50. (See details below)

Should Corzine spend $530 million to increase rebates, but not double tenant credits, the increase to these benefits would be scaled back by 33 percent from his original budget proposal. The maximum increase to a senior homeowner rebate would be $85.80 and all other homeowners would receive a maximum increase of $23.10. If tenant credits were doubled, we have no idea what the maximum increase to tax rebates might be, but certainly well below the previously proposed maximum increases of $85.80 and $23.10.

In our opinion, it would be better to consolidate the six direct property tax relief programs into one efficient and equitable program. This change would save on administrative costs and provide greater benefits to more people without spending any additional tax revenue.

With the average property tax bill now exceeding $6,000, very few average homeowners would consider it worth spending $350 million to get an extra $16.60 to $23.10, much less going to the trouble of amending the state’s constitution to make the small increase permanent.

The New Jersey PAMS technology will enable the state to provide the appropriate property tax relief benefit based upon age, income, disability, veterans status and property tax bill without exceeding any resident’s actual property tax expense. Today, property relief benefits can and do exceed residents’ actual property tax costs because of the piecemeal fashion in which relief is provided. Here’s how it happens.

Senior and disabled homeowners with incomes of $51,465 or less have not paid any property taxes increases since 1998 under the state’s property tax freeze program. In addition, these homeowners receive property tax rebates and credits that total a minimum of $1,000 to a maximum of $2,330. The lower the homeowner’s income the greater the property tax relief benefit. (See details below)

The property tax freeze along with combined direct property tax relief benefits results in some senior/disabled homeowners receiving a benefit greater than their actual property tax bill. For example, Camden’s current average property tax is $1,145.

Consolidating the various freeze, exemption, credit and rebate plans would enable the state to stop providing a total benefit greater than a homeowner’s actual property tax bill so that greater property tax relief could be extended to other senior and disabled homeowners with similar incomes, but with higher property tax bills.

The same concept should be applied to all senior/non-senior tenant property tax relief benefits, as well as for all other homeowners. For example, Newark’s average per capita residential property tax is $375, so clearly property tax relief benefits are exceeding the actual property tax expense for many residents. (See details below)

It is patently unfair for any resident to receive property tax relief benefits greater than the property tax bill they must actually pay, whether it is paid directly to a municipality or indirectly to a landlord. If there is a need or desire to grant additional income subsidies, separate programs should be passed into law and funded. A property tax relief program should be limited to the stated purpose, reducing a person's actual property tax burden.

Current Direct State Property Tax Relief Programs

Senior/Disabled/ Veteran Homeowners

Senior and Disabled Homeowner Property Tax Freeze

Since1998, New Jersey’s low-and middle-income senior and disabled homeowners (income $51,465 or less) have had 100% of their property tax increases paid through the state’s Senior and Disabled Citizens’ Property Tax Freeze program.

The Senior Tax Freeze program reimburses homeowners for any property tax increases assessed after the senior/disabled resident qualifies for the program. Property tax freeze payments are increased annually as local property taxes increase. (NJ Budget – Page B24).

Senior and Disabled Homeowner Property Tax Rebate

Senior and disabled homeowners receive a property tax rebate based upon income. Homeowners with an income of $70,000 or less receive a rebate between $1,000 and $1,200. Those with incomes of $70,001 to $125,000 receive from $600 to $800 and those earning $125,001 to $200,000 receive a $500 rebate. (NJ Budget – Page B24).

New Jersey Earned Income Tax Credit

The NJEITC program provides low–income residents (income $35,263 or less) with a payment equal to 20% of their federal EITC benefit. The maximum NJEITC is $880. (NJ Budget – Page B24).

Senior/Veteran/Disabled Local Property Tax Credit

Veterans and qualified senior and disabled residents receive a $250 credit on their property tax bills. The state reimburses municipalities for the credit qualified homeowners receive on their property tax bill. (NJ Budget – Page B25).

Property Tax Exemption for Disabled Veterans

Full exemption from property taxes on a principal residence for certain totally and permanently disabled war veterans and their unmarried surviving spouses/domestic partners. Unmarried surviving spouses of servicepersons who died on wartime active duty may also qualify. This benefit is administered by the local municipality

Senior and Disabled Tenants

Senior and Disabled Tenant Property Tax Rebate

Senior and disabled tenants receive a property tax rebate based upon income and filing status. Married, widowed and head of household tenants with an income of $70,000 or less receive a rebate between $150 and $825. Those with incomes of $70,001 to $100,000 receive a $150 rebate.

Single tenants with an income of $35,000 or less receive a rebate between $150 and $825. Those with incomes of $70,001 to $100,000 receive a $150 rebate. (NJ Budget – Page B24).

New Jersey Earned Income Tax Credit

The NJEITC program provides low–income residents (income $35,263 or less) with a payment equal to 20% of their federal EITC benefit. The maximum NJEITC is $880. (NJ Budget – Page B24).

All Other Homeowners and Tenants

Homeowners

Homeowner Property Tax Rebate

Homeowners with an income of $70,000 or less receive a rebate of $350. Those with incomes of $70,001 to $125,000 receive $250 and those earning $125,001 to $200,000 receive a $150 rebate. (NJ Budget – Page B24).

Veteran Local Property Tax Credit

Veterans receive a $250 credit on their property tax bills. The state reimburses municipalities for the credit qualified homeowners receive on their property tax bill. (NJ Budget – Page B25).

New Jersey Earned Income Tax Credit

The NJEITC program provides low–income residents (income $35,263 or less) with a payment equal to 20% of their federal EITC benefit. The maximum NJEITC is $880. (NJ Budget – Page B24).

Tenants

Tenant Property Tax Rebate

Tenants with an income of $100,000 or less receive a rebate of $75 .(NJ Budget – Page B24).

New Jersey Earned Income Tax Credit

The NJEITC program provides low–income residents (income $35,263 or less) with a payment equal to 20% of their federal EITC benefit. The maximum NJEITC is $880. (NJ Budget – Page B24).

Carnival of the New Jersey Bloggers # 62

Click the Graphic for More Information

Have you been Pluck(ed) out for a BlogBurst? The Art of Getting By wants your thoughts.

Bob the Corgi’s Florida Chronicles.

DynamoBuzz points out nobody is paying attention.

TigerHawk remembers five years ago.

Riehl World View reminds us there was fair warning.

If you’re wondering whether the rise in the price of gold is over, check out the Stock Market Beat.

Happiness is making $12,000 a year or less explained on Fausta’s Blog.

Dossy asks, exactly what is a sense, anyway?

The Boomer Chronicles offers 3 strange things to see in New Jersey.

Parkway Rest Stop writes on justice - Jersey style.

Jay Lassiter’s run in with the KGB as ball person.

Find out about the home of pirated CDs and other hilarity on Joe’s Journal.

Edublogging at BlogHer from Professor Kim's News Notes.

eCache presents the anatomy of a tax.

Diplomacy and the Hounds of Hell, Part XIII from A Blog for All.

"D"igital Breakfast has a featured stock market chart of the day and a daily podcast to go along with each one.

Corzine’s Blueprint For Property Tax Relief

Our post outlining Governor Corzine’s blueprint for property tax reform may be read here.

Our analysis and comments concerning Corzine’s blueprint for property tax relief and reform will be covered in future posts.

Update: Read our post Creating An Equitable And Efficient New Jersey Property Tax Relief Program

The State’s Financial Condition

If we were a business, we’d be bankrupt.

Need For A Property Tax Relief Program

We all have to acknowledge that the reforms we implement will take time before the public feels the results.

Now, I’m not Noah Webster, but in the Corzine lexicon, relief is direct assistance brought quickly to reduce what someone actually pays.

Current Property Tax Rebate Program

Currently, we send rebate checks to the public as a means to lighten the burden and dampen the regressivity of property taxes on seniors and middle-income families.

We call this property tax relief, but I think many of you would agree that few people outside of Trenton actually make the connection.

New Property Tax Relief Program

If we want to lower people’s property tax bills, then we ought to do just that.

Replace the checks with direct credits that will lower the bill someone pays.

My administration will have the technology in place to do this by July 1, 2007.

I propose that we take $350 million of the dedicated sales tax revenue and combine it with the existing funding for rebates.

This will create a credit program of more than $1.6 billion to lower tax bills for senior citizens and middle-class families and to potentially double the credit for tenants.

Corzine’s Property Tax Reform Blueprint

This post deals exclusively with the property tax reform aspects of the Governor’s speech given today before a joint legislative session. We havel covered Corzine’s ideas for property tax relief in a separate post, which may be read here. Our analysis and comments concerning Corzine’s blueprint for property tax reform and relief will be covered in future posts.

This post is broken down into three main sections - Defining The Property Tax Problem, Major Causes of New Jersey’s Property Tax Problem and Property Tax Solutions and Action Plans.

I. Defining The Property Tax Problem

Property taxes have been going up by an average of 6.5% a year for the past 20 years and at 6.9% since 2001, a period of time when, not surprisingly, aid to municipalities and schools was essentially held flat.

The total property tax levy today is $20 billion. Without action, it will double to nearly $40 billion within a decade.

It is all too clear to everyone, the property tax burden is simply overwhelming our citizens and their economic well-being.

II. Major Causes of New Jersey’s Property Tax Problem

1. Unsustainable Public Employee Benefit costs

Today, we face an $18 billion unfunded pension liability that is one of the factors that limits our ability to provide meaningful local aid.

Over the next four years, we can expect costs for the State Health Benefits Program to grow by more than 70% to over $3.6 billion. And we face an unfunded health care liability of at least $20 billion.

2. Ballooning State Debt

Years of postponing tough choices through more borrowing have left us with the third highest debt burden in the nation – over $3,200 per person.

This year our state budget carries $2.3 billion in debt service and will expand by more than 25% in just four years.

3. Unfair State Aid Funding Formulas

And within the state budget, we must acknowledge that many of our aid formulas, especially school aid, are outdated, ineffective and outright unfair.

4. Lack of Financial Accountability

Audit oversight exists in almost every facet of our economy.

Disastrous breakdowns with the internal controls at UMDNJ and the Schools Construction Corporation make this need obvious and mandatory.

5. Home Rule Cost Inefficiencies

To be blunt, if we don’t find a way to drive down costs through shared services, we will never get real reductions in spending.

6. Out-of-Date State Tax structure

The property tax provides 46% of all tax revenues in New Jersey. The national average is roughly 30%.

Now I can already hear the spin machines starting to warm up. But we are kidding ourselves if we pretend we can fundamentally alter the property tax equation entirely on the spending side.

7. Failure of Previous Property Tax Relief/Reform Efforts

As the public knows, ideas to reform and reduce property taxes have been debated ad infinitum.

We have to create mechanisms to contain spending that will stand the test of time.

III. Property Tax Solutions and Action Plans

Everything must be on the table – sacred cows, third rails, 800-pound gorillas – all the issues that government for too long has been unwilling to address.

So let us join together and agree that before the end of this calendar year, we must have in place comprehensive property tax relief and reform to truly address this crisis.

1. Reduce Public Employee Benefit Costs

Our first challenging step in addressing reform will be pension and benefit arrangements for our public employees at every level of government.

Union Public Employee Benefits

That said, I don’t believe we have the legal or moral authority to break a deal or take away non-forfeitable rights.

We also have a collective bargaining process that I respect, and it is through that process that these challenging reforms should be addressed.

a. Two-tiered system

Reality dictates we must consider two-tiered systems in all benefits for new and recently hired employees.

b. Pensions

We must also look at increasing the retirement age for new hires.

In these negotiations and your deliberations we must address broad changes to the retirement system, including the potential introduction of means-tested defined contribution plans.

c. Health Insurance

The negotiations must also bring important changes to health care by negotiating alternate plans such as PPOs, eliminating outdated coverages and most importantly employee cost sharing.

Non-Union Public Employee Benefits

Outside of the collective bargaining process, the Legislature can act immediately to eliminate the practices and loopholes that allow professional service providers, political appointees and people who barely work to enjoy the benefits of a system intended for career public employees. Eliminating these items – a.k.a. padding, boosting, and tacking – is a no-brainer.

2. State Aid Allocated To Achieve The Greater Good

a. Revise State Aid Formulas

There is, however, a greater good that we must achieve by doing what is right for the state, and that means we must revise these formulas. One – recognize the needs of every child regardless of zip code. Two – live within the realities of our state finances. And three – meet the obligations of our Constitution.

3. Reduce State Debt

a. Sell State Assets To Raise Funds

Within three months, my Administration will present an asset and liability study with recommendations on the sale, lease or monetization of assets, the use of naming, development and air rights as well as other public-private partnerships to raise capital and reduce debt payments.

b. Pay Down Debt

With this plan, we will reduce the debt load in New Jersey and release billions in free cash flow over the next four years.

4. Reduce Home Rule Inefficiencies and Costs

a. Municipal Consolidations and Shared Services Arrangements

Communities can achieve greater savings and potentially better services – in everything from tax assessment, to trash collection, to school administration – through cooperative efforts.

I support ideas like those put forward by Speaker Roberts in the CORE plan to use counties, schools and townships to provide more regional services.

c. Provide State Funds As Incentive To Consolidate and Share Services

To make shared services work, we have to provide a substantial budget carrot or nothing of scale will happen.

I propose that we use $250 million per year of the dedicated sales tax to create an unprecedented Reengineering Fund.

The goal is to provide financial incentives so powerful that towns, counties and school districts will have little economic choice but to share services and reduce costs.

d. Revise Civil Service Laws

As a part of this effort, we should review our archaic, overly complex civil service laws that are often roadblocks to shared service agreements and effective management at all levels of government.

e. Set Standards and Measure Results

To implement this effectively, we will need objective standards, independent analysis and a means to verify results.

We need to create a financial control board to measure and assure progress.

5. Change Tax Structure

a. Reduce Dependence on Property Tax

The property tax must become less and less a portion of the total funding pie.

b. Modernize Tax Structure

In this context, we have to examine how the economy has changed and see whether our tax code should be changed accordingly.

The goal of modernization is to capture revenues that can be used to provide local aid and reduce property tax pressures without causing undue harm to our economy.

c. Allow Municipalities to Impose Taxes and Fess

We also have to take a serious look at whether we should give local communities a limited right to raise new revenues, including the right to impose impact fees.

If local citizens choose other revenue sources to lessen their property tax burden, then who are we in Trenton to tell them they don’t have the right to an alternative course.

By allowing communities to decide to utilize other revenues, we are giving them additional options aside from the property tax.

6. Improve Financial Accountability

a. Create Comptroller Office

I am prepared to work with the Legislature to create an appointed Comptroller with a term of six years to ensure the office’s independence.

b. Financial Audits of Government

And as I have repeatedly argued, we need an independent and properly staffed State Comptroller to systematically and regularly review financial activities of all governmental units and authorities.

c. Greater Public Participation In Budget Decisions

Public participation can be a check on spending, as we saw with this spring’s school budget elections.

Budget elections should be more democratic and potentially held at the same time as general elections.

7. Create Sustainability of Reform

a. Cap Property Tax Increases

We need to cap the annual increase in the property tax, not a new cap on spending, but a cap on the increase in the property tax bill itself.

We can fashion provisions to cope with inflation, population growth and changing needs.

But no homeowner, no property owner, should have an increase in their annual property tax bill greater than 4%.

This cap would cut the recent spiraling rate of increases by more than a third.

b. Evaluate Results

We should also include a four-year sunset provision so that we can evaluate the cap’s impact.

Kyoto

The US did not sign the Kyoto Protocols, Canada did. Who has been more effective in reducing emissions?

U.S. manufacturing facilities cut their releases of toxics by 21 per cent between 1998 and 2003, while Canadian manufacturers cut releases by 10 per cent.

Have You Received Your New Property Tax Bill? We Did.

What services do counties provide besides picking up recyclables a couple of times a month? We could live without that service. As each of the municipalities we live in requires residents to arrange and pay privately for garbage removal, undoubtedly something could be worked out where our recyclables could be removed at the same time as our other trash for a modest fee increase.

If ever there was a redundant level of government in New Jersey, it has to be county government. How about we do this? Once someone figures out what the country does, citizens could decide what they’d like to have government continue doing and have those services provided either by the state or the local municipality. Keep the towns, get rid of the counties - now that would be real property tax relief.

Why Is New Jersey A Financial Mess?

Since 2002, the number of state government workers has grown 10 times faster than New Jersey’s population. The state’s per capita income has grown by 11 percent, from $39,453 to $43,771, while New Jersey state spending and taxes have increased by 35 percent. State debt has increased 214 percent. (See details below)

The state’s public workforce has grown less efficient, even as New Jersey invested millions in technology to improve productivity. Would any business hire 20 percent more workers to support less than 2 percent more customers? State spending is outpacing the income gains of its citizens and its businesses. State taxes are eating up a larger percentage of the public’s income every year.

This is why New Jersey has become less affordable, more heavily taxed and a financial basket case. And contrary to political rhetoric, federal funding to New Jersey has not been cut or reduced exacerbating the state’s budget woes. Overall, federal funding to the state has increased 29 percent, from $6,458,560,000 in 2002 to $8,348,666,000 in 2006. Federal funding for New Jersey public schools has increased 46 percent, from $571,918,000 in 2002 to $835,799,000 in 2006.

The total number of New Jersey State employees is 152,000. This figure includes employees with various state authorities, hospitals and state colleges, who are not considered executive branch workers.

New Jersey Property Tax Reform

Let’s say I live in West Orange, have an income of $100,000 and have a retired neighbor making $50,000. My home and my neighbor’s have the same property tax valuation. Our town receives $1,078 per homeowner in property tax relief from the state, producing a property tax bill of $10,000 for both of us. The average cost per student in West Orange is $10,980.

My retired neighbor pays $875 in state income taxes for New Jersey’s “property tax relief fund” and I pay $5,250 into the fund. My neighbor is eligible for a senior citizen property tax rebate of $1,200. I am eligible for a rebate of $250.

My neighbor pays a net total tax of $9,675 and I pay a total of $15,000. I’m paying about 55 percent more for the two taxes than my neighbor.

My neighbor has a friend living in Newark who is also retired with an income of $50,000. Newark receives $23,737 per homeowner in property tax relief from the state, producing a property tax bill of $3,200 for my neighbor’s friend.

My neighbor’s friend pays $875 in state income taxes for the “property tax relief fund” and receives a senior citizen property tax rebate of $1,200. The friend’s net total tax is $2,285.

My neighbor pays 423 percent more in taxes than his friend and I pay 656 percent more than the friend in Newark.

The average cost per student in Newark is $15,796. Newark's per capita cost for local government is $5,197 and for West Orange it's $3,338. School taxes in Newark have not been increased since 1998 and as Newark’s mayor Sharpe James bragged, the city’s property tax rate is the lowest since Newark adopted its present form of mayor/council government in 1954.

So to recap, Newark spends 44 percent more per student and 56 percent more per person for all local government services than West Orange. I am paying 55 percent more in taxes than my neighbor and 656 percent more than the friend in Newark. My neighbor is paying 423 percent more than the friend. I am paying 15 percent of my income for property taxes and property tax relief. My neighbor is paying 19 percent of his income and the friend is paying almost 5 percent of his income for the two taxes.

Now along come the property tax reformers claiming I’m not paying ”my fair share” in taxes. To reduce property taxes, income taxes must be increased and my town of West Orange should consolidate schools and services with other Essex County municipalities to save money.

Of course you never hear exactly how much more in total income and property taxes a “rich” person like me should be paying in order to achieve the distinction of paying my “fair share”. Perhaps the reformers can show us the new “fair share” income tax rate table.

You also never hear how consolidating schools and services such as police will save money. If two or more towns merge, will there be a need for fewer schools, classrooms or teachers? Yes, if you’re willing to increase the number of students per classroom, but school consolidation isn’t necessary to increase the number of students per classroom.

Does school consolidation reduce the number of text books and other supplies needed per student? How about the number of school administrators and support personnel per student, would that change with consolidation? So where exactly are the “savings” to come from – the elimination of a school superintendent or two from the consolidated towns?

The same with merging police departments, how are the savings achieved? Fewer police per resident, larger patrol areas per officer? Consolation isn’t necessary to put fewer police to work in a community.

Perhaps there are some really big savings we’re missing with the consolidation idea and the reformers will be able to give us the actual details using West Orange as an example. With which municipality or municipalities would West Orange merge? What would be the total savings by municipality and what would each homeowner’s property tax bill be, before and after consolidation?

Perhaps the reformers can also explain why Newark and similar municipalities with far higher costs per capita for the delivery of local government services are being left out of the cost cutting initiatives?

Oh, who cares, right? It’s only your money and goodness knows, politicians have proven they can be trusted to spend it wisely and do what’s best for “the common good.” Besides, why not do away with property taxes completely? Just triple the state income tax rates and ta-da, 100% property tax relief.

Carnival of the New Jersey Bloggers # 61

Click the Graphic for More Information

Sharon from The Center of NJ Life offers number six in her New Jersey Treasure series.

Podcast interview with GiggleChick - Listen to Laugh Riot: Episode 2

The Baristanet neighborhood had a microburst.

Bob at eCache says whatever happened to “We must stop borrowing and using gimmicks.”?

"Who You Gonna Call?" Cinnaman wants to know.

Lawhawk says, What we have here, is a failure to communicate.

Confessions of a Jersey Goddess asks, “Are you really surprised?”

Schadenfreude at The Fifth Column at the nexus of his quitting smoking progress and the situation in the Middle East:

Stock Market Beat says, “We want to take advantage of the shorter-term movements, when possible, without violating the overall sit tight principle”.

Tom from "D"igital Breakfast recently had an epiphany making him rethink how he looks at both his real estate and stock investing for the long term.

There’s Got To Be A Better Way

On June 8, the first of New Jersey Transit’s planned fleet of 231 bilevel trains, which cost about $1.9 million each, slipped out on a midnight test run to New York.

Built taller and wider than traditional suburban commuter trains, the ‘double-decker’ had difficulty passing through one of the two tunnels heading into Pennsylvania Station, tearing down two signals as it chugged past the west end of track 5.

A spokesman for New Jersey Transit, Dan Stessel, said that the train that tore down the signals suffered only “minor cosmetic damages.’’

He said that no passengers were on board that night, and that the train’s engineer and its conductors were not injured.

Federal Tax Cuts Have Not Caused New Jersey Taxes To Increase

Before we quote from the Blue Jersey post in question, a few facts are in order.

Since 2001 New Jersey public school enrollment has increased by almost 4 percent and federal funding for New Jersey’s public schools has increased by 69 percent. This past year the state’s public school enrollment increased by .003, that’s less than one-third of 1 percent. Federal funding for New Jersey’s public schools increased by 2 percent over last year. This past school year, New Jersey public schools spent $16,547,310,169 and the federal government contributed about 5 percent to that total, $835,799,000. (See data detail and links below.)

Since the “Bush tax cuts” of 2003 federal tax revenue has grown to an all-time high and the federal income tax has become more progressive, not less. As the New York Times reported earlier this month “contrary to a popular assumption, a disproportionate share of income taxes is paid by wealthy households” and a “steep rise in tax revenues from corporations and the wealthy is driving down the projected budget deficit this year”

Bonus information:

Did you know that just over the past 11 quarters, dating back to the June 2003 Bush tax cuts, America has increased the size of its entire economy by 20 percent? In less than three years, the U.S. economic pie has expanded by $2.2 trillion, an output add-on that is roughly the same size as the total Chinese economy.As they say, read the whole thing, but here are a few paragraphs from the second part of a Blue Jersey blogger’s missive on why federal tax cuts are driving up New Jersey state and property taxes. We commented on part one here. Yes, we know the cost per student used in his example is for illustrative purposes, but the scenario, assumptions, percentages used for enrollment increases and federal funding are without any basis in reality.

Let's say that a school has 100 students and recieves $10 per student from the federal government. Woohoo - they get $1,000. Next year, they will have 150 students, but the feds will only give them $9, or a total of $1,350.

Now we also figure that it costs $20 per student to provide education. So overall spending per student in the first year was $2,000, and since the feds picked up half, state and local government only had to pay $1,000. In the second year, total spending was $3,000, of which the feds paid $1,350. The state and local govenments, then, had to pay $1,650.

Did federal spending on education go up or down? If you look at overall federal spending, it obviously went up - 35%, in fact. However, overall education spending went up by 50%. The tab for the state governments went from 50% of the bill to 55% - an increase of $650. That's an increase of 65% in the state and local government tax bill.

Getting confused yet? Sorry for inflicting the math on you. It's necessary to demonstrate the problem with a growing education system. Funding it at a lower rate allows the federal government to claim that it is paying more while it is actually leaving an even higher burden to state and local governments.

Here's another consideration. The federal tax dollars are a progressive tax on income. State and local taxes are largely regressive taxes on property. Which pool of taxpayers is larger - those who own property or those who have income? If you said "Income", then give yourself a cookie. (Note: most non-property owners still get charged property tax through their rent, it just isn't collected as such)

So not only are state and local taxes going to be raised more than federal taxes are cut, but the burden will be shared by a smaller pool of people with less regard for their ability to pay. In other words, the poor will get poorer and the rich will get richer. And, by the way, your schools will get overcrowded. Did you see any money left over to build a new school for the new 50 kids?

Enrollment school year 2001-2002 = 1,341,503

Enrollment school year 2004-2005 = 1,390,826

Enrollment school year 2005-2006 = 1,394,779

Federal Funding for NJ Public Schools

Federal funding for NJ public schools 2001 = $495,695,000

Federal funding for NJ public schools 2005 = $821,115,000

Federal funding for NJ public schools 2006 = $835,799,000

School Year 2005-2006 - Total Cost NJ Public Schools

Total Cost of New Jersey public schools = $16,547,310,169 (school year 2005-2006)

348,695 Abbott students x $14,287 cost per student) = $4,981,805,465

1,046,084 non Abbott student x $11,056 (cost per student) = $11,565,504,704

The 31 Abbott school districts receive over 56% of property tax relief (state aid) for public schools and make up 25 percent of New Jersey’s public school enrollment.

One-hundred percent of New Jersey’s income tax is spent on property tax relief. New Jersey households reporting over $100,000 in income account for 80 percent of the state’s income tax revenue and 42 percent of state income taxes are paid by 1 percent of filers.

The state of New Jersey will also distribute $1.2 billion in property tax rebate checks to senior citizens and to homeowners and renters with incomes of $70,000 or less.

The first round of New Jersey Schools Construction funding was allocated with the Abbott school districts, representing 25 percent of public school enrollment, receiving $6 billion and the remaining school districts, representing 75 percent of student enrollment, receiving $2.6 billion. The Star-Ledger determined that the schools built in Abbott districts through this state program cost 45 percent more than locally managed and funded school construction projects.

Corzine Comes Up With Another Property Tax Relief Scheme

Corzine said floating bonds backed by the new sales tax proceeds could provide a quick and massive one-time influx of cash to "stimulate the right kind of behavior patterns for change" among local governments.We thought Corzine said the state had to extend the sales tax and increase the tax from 6 to 7 percent because New Jersey needed the money to close a budget gap. Now he claims we can use this extra revenue to borrow $7 billion to stimulate change in behavior patterns.

Corzine acknowledged the plan would only provide a one-time source of cash, but said if it was used to bring about consolidation of local government, "you would get a payback" in long-term property tax savings.

If local governments could save money by consolidating and sharing services, shouldn’t the cost savings be enough incentive? Why should the entire state have to a pay a bribe for this to happen?

The governor said the promise of big-money incentives could prompt voters to pressure their local governments and school boards toward consolidation. He said county governments could offer a "good point of consolidation" for local governments to fold into.Now the truth comes out. Let’s have bigger government and pool all the property tax money into one big county pot. That way, for example, Newark will control how property taxes are raised and spent in Essex County.

"If you wanted to say, okay Essex County, you do these 10 things, we'll give you a billion dollars ... If you don't meet these constraints you don't get the dough," Corzine said. "Then the voter might find it compelling."How about we say, okay Newark, you do these 10 things, and we’ll let you keep getting the billions we send you every year. If you don’t meet these constraints you don't get the dough. The voters in Newark might find that offer compelling too.

"I honestly don't understand what he means," [Sen. Leonard] Lance said of the governor's remarks. "I do not favor borrowing to provide a stream of funding for property tax relief. It violates every principle of sound fiscal policy that I know. It's how we've gotten into trouble in the first place. Here we go again."

State Treasurer Bradley Abelow said borrowing against a dedicated state funding source is not new. Similar borrowing has provided funds for transportation, open space acquisition and, before a 2004 Supreme Court ruling, to balance the budget.

Corzine said the state had several other options to consider for lowering property taxes.

He said the state could "tinker with the income tax brackets" and extend the sales tax to more purchases.So there you have the options Democrats are considering for property tax relief. We can borrow a ton of money, raise the income tax or extend the sales tax even further. Perhaps we could even do all three.

Saving money though shared services and voluntary municipal consolidations, without spending money for bribes, is a good idea. However, if New Jersey’s goal is to reduce the total state and local tax bite, here are the real problems that must be addressed.

New Jersey spends 57 percent more per public student than the national average.

New Jersey’s 31 Abbott* school districts spend 30 percent more per student as compared to the rest of state. Average per-pupil spending in New Jersey school districts is $11,056. Abbott districts average $14,287.

The 31 Abbott* school districts will receive over 56% of property tax relief (state aid) for public schools in 2007 and yet make up only 25 percent of New Jersey’s public school enrollment.

The 31 Abbott* municipalities receive the bulk of all state municipal aid which also reduces local property taxes.

The only solutions to New Jersey’s property tax crisis are through cost containment, especially on salaries and benefits, where the bulk of the relentless cost increases come from and an equitable distribution of state property tax relief funds from existing tax rates and revenue sources.

* Thirty-one of the state’s 566 municipalities are designated as “Abbott” for the purposes of “property tax relief” related to education aid and “needy” for the purposes of “property tax relief” related to all other municipal aid.

Federal Funding To New Jersey Has Increased 43 Percent Since 2001

The mix of federal to state dollars directly impacts our state and local taxes. When federal taxes are cut, our state and local taxes are raised to make up the difference.Our friends must have missed the news as recently reported in the New York Times - Sharp Rise in Tax Revenue to Pare U.S. Deficit. Still, that doesn’t tell the whole story, because you need to know if New Jersey has been receiving more or less federal funding since federal taxes were cut in 2001 and again in 2003.

Here are the facts. Since 2001 federal funding to New Jersey has increased 43 percent and federal funding for education to New Jersey has increased 69 percent.

Federal Funding for NJ 1999 - $4,818,619,000 (Education= $404,043,000)

Federal Funding for NJ 2000 - $5,072,801,000 (Education = $444,988,000)

Federal Funding for NJ 2001 - $5,848,945,000 (Education = $495,695,000)

Federal Funding for NJ 2002 - $6,458,560,000 (Education = $571,918,000)

Federal Funding for NJ 2003 - $6,769,698,000 (Education = $703,131,000)

Federal Funding For NJ 2004 - $7,248,990,000 (Education = $766,519,000)

Federal Funding for NJ 2005 - $7,360,683,000 (Education = $821,115,000)

Federal Funding for NJ 2006 - $8,348,666,000 (Education = $835,799,000)

Source: New Jersey Department of the Treasury

As hard as this is for some people to believe, the facts are that New Jersey state and local taxes have increased because New Jersey governments have been spending more money. New state taxes, increased fees and higher tax rates have been imposed because state spending is growing faster than the rate of increase in personal and business income.

Bob Menendez Misrepresents The Facts About Homeland Security Funding

As we have written many times, President Bush favored a risk based formula, but Senator Patrick Leahy (D-VT.) held passage of the Patriot Act hostage until a different method for allocating homeland security funds to the states was adopted. The name of the formula used is called The Leahy All-State Minimum Formula.

Below is a screen capture from Leahy’s website. As you can see, Leahy takes credit for creating the formula and for getting Congress to reject the President’s proposal to end the Leahy all-state minimum formula.

Where Do New Jersey Democrats Stand On Stem Cell Research?

You’d never know that this year the federal government is spending roughly $200 million for somatic (adult and umbilical cord) stem cell research and $38 million for embryonic stem cell research. Some might be shocked to learn that American businesses privately fund and conduct stem cell research. Tom Kean, Jr. recently visited a stem cell research facility right here in New Jersey that's owned by the Celgene Corporation.

Listening to all the hyperventilating by New Jersey politicians you’d think stem cell research was a top priority for Democrats. Reality tells a different story.

Back in January 2005, Governor Dick Codey announced the state of New Jersey would undertake two stem cell research initiatives - a $150 million dollar investment for the construction of the New Jersey Stem Cell Institute and a $230 million dollar investment for actual research.

What happened? Democrats allocated $370 million in the budget for what are called "Christmas tree" grants, money for projects that strictly benefit a legislator’s home district. The state’s 2005-2006 budget contained only $5.5 million for stem cell research. Turns out stem cell research really wasn’t a priority for Democrats.

Next, Jon Corzine made state funding for stem cell research a major issue in his campaign for governor and Democrats in Trenton again took up the matter in the spring of 2006. This time Democrats proposed building not just one, but three new stem cell research centers - one for a $150 million in New Brunswick, one for $50 million in Camden and another for $50 million in Newark. The bond referendum for actual research was to be increased from $230 million to $350 million.

So what happened? First, state Senate President Dick Codey put the kibosh on asking voters to approve a bond referendum of $325 million. Codey made his announcement at a state owned stem research center at Rutgers University in Piscataway. Yes, the state of New Jersey already owns stem cell research facilities.

During a news conference at a stem cell research center in Piscataway, Codey said it would be too hard to sell the proposed $325 million borrowing package to voters while the state is in such bad fiscal shape.Then came the passage of the $31.9 billion New Jersey state budget for 2006-2007. What happened to the money for building one, two or three new stem cell reach facilities? Once again, more than $300 million in new spending was inserted by Democrats at the last minute for pork barrel projects and zero funds were allocated for building new stem cell research facilities. The new budget contains exactly $5.5 million for actual stem cell research, the same as last year. Stem cell research apparently wasn’t much of a priority for Governor Corzine either.

Now comes an article on Politics NJ.com written by Bill Albers entitled Menendez accuses Kean of Stem Cell flip-flop. Tom Kean Jr. supports increased federal funding for stem cell research, but opposed adding new spending for that purpose to New Jersey’s budget. At the end of the day, Kean must have been with the Democrat majority on this issue, because as we know Corzine received exactly what he asked for in the budget – a zero dollar increase for stem cell research. Menendez called Corzine’s budget the "most honest, fiscally responsible budget in years. So Menendez apparently agreed with Corzine’s decision not to increase state spending on stem cell research.

So, exactly which politicians and which party has been doing the flip-flopping on New Jersey state funding for stem cell research? Democrats talk about stem cell research a great deal, they enjoy making it a campaign issue, but when it comes to actually doing something about it – just about everything under the sun is a more important for them to fund than stem cell research.

And will someone please tell Bill Albers this sentence in his article is completely false.

Federal funding for research on embryonic stem cells has been disallowed by the Bush administration since 2001.It was the Clinton Administration that did a lot of talking about funding embryonic stem cell research, but never got around to actually spending any money on it. (Sound familiar?) It was the Bush administration that actually funded embryonic stem cell research in 2001, for the first time in our nation’s history. Tom Kean Jr. would like the fefederal government to spend more.

Linda Stender Wants To Raise Federal Taxes

Democrat Congressional candidate Linda Stender still doesn’t have any issues or policy positions on her website, but she has posted this video. We thought we’d share it with you and help get her message out – she wants to raise your federal taxes.

Watch Emily’s List President Ellen Malcolm at a recent event explain why state Assemblywoman Linda Stender (D-Union) is the best person to raise federal taxes on New Jersey families should she be elected to Congress. As Malcolm says, Stender will listen to the advocacy organizations “we all love” and has a proven record of raising taxes right here in New Jersey. Watch Stender look on approvingly, shaking her head and applauding.

After all, New Jersey is home to four out of the top twenty wealthiest congressional districts in the entire country. Surely voters in the NJ 7th, ranked number six on the list, know when Stender and her buddy Senator Bob Menendez are talking about raising taxes on the ”wealthy” they are talking about you.

But, before Stender can do for the country what she helped do for New Jersey, she needs money, lots of it. So, all of you voters out there in the New Jersey 7th Congressional District, just itching to pay more federal taxes, why not send a big fat check off to Linda Stender today.

Another Property Tax Relief Shell Game

Today, it has some heavyweight backers, including Gov. Jon Corzine, Assembly Speaker Joe Roberts (who actually got the Assembly to approve it last session), the League of Municipalities, the League of Women Voters, the AARP, the Black Ministers Council and environmental groups.To buy into this solution you have to believe property taxpayers and state taxpayers are nearly mutually exclusive groups, which of course they’re not. And you also have to believe you’d be happier if your total tax bill remained the same, just as long as your property tax bill was temporarily less.

The convention's plan would have to be revenue-neutral, neither raising nor lowering the total tax take. It simply would redistribute the burden so that property owners wouldn't bear such a disproportionate share. Once completed, the plan would go to the voters for a yes or no verdict.

The fact Democrats are concerned that people will catch on to their latest tax hiking scheme should be a major tip-off that a constitutional convention is bad news for taxpayers. That's why lawmakers want to hold this plan until an off-election year.

Next year is an election year, with all 120 legislative seats on the line. If candidates were required to share the ballot with a comprehensive, controversial, convention-produced reform proposal -- which doubtless would include higher state taxes to offset local property taxes -- they would be compelled to take a position on it.On the other hand the state’s legislature could actually do their job instead of passing their responsibilities off to another group – wasting even more time and tax dollars in the process. State government gave New Jerseyans the state income tax for the sole purpose of reducing property taxes. Before Democrats concoct any “new solutions” they should fix their “old solution” for the property tax crisis in New Jersey. They can begin with these issues:

New Jersey spends 57 percent more per public student than the national average.

New Jersey’s 31 Abbott* school districts spend 30 percent more per student as compared to the rest of state. Average per-pupil spending in New Jersey school districts is $11,056. Abbott districts average $14,287.

The 31 Abbott* school districts will receive over 56% of property tax relief (state aid) for public schools in 2007 and yet make up only 25 percent of New Jersey’s public school enrollment.

The 31 Abbott* municipalities receive the bulk of all state municipal aid which also reduces local property taxes.

Don’t let New Jersey politicians trick you with yet another shell game that raises state taxes to hopefully reduce your property taxes. It hasn’t worked yet and it never will. The only solution to New Jersey’s property tax crisis is through cost containment and an equitable distribution of state property tax relief funds from existing tax rates and revenue sources.

* Thirty-one of the state’s 566 municipalities are designated as “Abbott” for the purposes of “property tax relief” related to education aid and “needy” for the purposes of “property tax relief” related to all other municipal aid.

Carnival of the New Jersey Bloggers # 60

Click the Graphic for More Information

Bob the Corgi hosts the Carnival of the New Jersey Bloggers #60

State Government Polices Are Destroying New Jersey

New Jersey, once synonymous with world-class research and cutting-edge technology, is facing its most uncertain future since the Great Depression.In New Jersey during the past five years, "there was very little concern about the impact of tax policy on the economy," Hughes said.

The center of gravity of America’s new knowledge based economy, as its manufacturing-based economy did a generation ago, appears to be shifting from the high-cost places of doing business of the Northeast to the lower-cost and more affordable states of the nation’s Sunbelt.

Overall, while the state lost 117,600 high-paying service and manufacturing jobs, it replaced them with 113,200 low-paying service jobs. The first half of the first decade of the 2000s has been characterized largely by the contraction of high paying, private-sector office and manufacturing jobs, replaced by lower-paying private-sector employment and expanding public-sector, tax dependent jobs.Since Democrats took control of Trenton in 2002, state spending and taxes have increased by 35 percent and debt has ballooned by a whopping 214 percent. New Jersey’s population has grown by less two percent, while the number of state government workers in the executive branch has increased by more than 20 percent. The increase in all public-sector jobs in New Jersey has been increasing at the rate of 9 percent.

New Jersey’s relative economic well-being has been slowly but clearly eroding. Combined with the much higher costs of living in New Jersey, this erosion of relative income has become an increasingly crucial public policy issue facing the state.Judging by the results of New Jersey’s elections for Governor and Assembly this past fall, as well as, the tax and spend frenzy witnessed this month in Trenton, the answer is a resounding – no.

Do public decision makers and the broader population of the state understand that New Jersey has likely entered a new era of below average economic growth? Does it matter to them?

For a long time, a significant (and rising) share of the state budget has been used to redistribute income. Too little attention and too few resources were consistently dedicated to growing income.The Bush administration has done just that at the national level and the country has experienced remarkable levels of economic growth, job creation, as well as, record levels of tax revenues.

Success for New Jersey in the competitive environment of the twenty-first century also requires a thorough examination of the business cost structures of the state and of appropriate changes to promote investment, risk taking, and job creation.

Wake up New Jersey, before it’s too late. Progressive state government polices are destroying New Jersey.

On Lowering New Jersey Property Taxes

Property taxes in New Jersey exceed $18 billion. Choose whatever percentage you’d like to reduce your property taxes, multiply by that $18 billion, and you’ll have the number of billions by which the state would need to raise taxes to reduce property taxes. Raising state taxes to reduce local property taxes is a losing proposition. (See History of New Jersey Property Tax Relief)

Now consider the facts:

New Jersey spends 57 percent more per public student than the national average.

New Jersey’s 31* Abbott school districts spend 30 percent more per student as compared to the rest of state. Average per-pupil spending in New Jersey school districts is $11,056. Abbott districts average $14,287, led by Asbury Park's $18,893.

In 1998, the Abbott* average cost per pupil was $8,438, the state’s average cost per student was $7,979. By 2006, the average Abbott cost had grown 69 percent, to $14,287.

Abbott districts have spent at these high levels without any requirement to raise their local levy [property taxes] beyond the amount raised in 1998. That has resulted in significant increases in per pupil spending in Abbott districts without any corresponding increase in local property taxes [in the Abbott districts].The 31* Abbott school districts will receive over 56% of property tax relief (state aid) for public schools in 2007 and yet make up only 25 percent of New Jersey’s public school enrollment.

Without cost containment and an equitable distribution of state property tax relief, taxes will continue to soar.

* Thirty-one of the state’s 566 municipalities are designated as “Abbott” for the purposes of “property tax relief” related to education aid and “needy” for the purposes of “property tax relief” related to all other municipal aid. The 31 municipalities designated as “Abbott” and “needy” were not subjected to the zero growth in state “property tax relief”, as other had the rest of the state for the past four years.

Who’s Creating Myths?

You have to laugh at some of the posters who say things like none of the property tax relief will go to Morris County. They either subscrbe to, or have created, the myth about rich and affluent Morris County being mistreated by the state.We don’t know if Snowflack is trying to bait people with baloney or just is totally unaware of the facts. Either way, he does a disservice to his readers and makes you wonder about his motives.

If there is property tax relief in the form of higher rebates, obviously, every homeowner will benefit. It makes no difference where they live.

And contrary to what some have said, more state aid to schools and towns definitely is property tax relief because it reduces what has to be raised locally. If local school boards and town councils do not use that money for property tax relief, is that the state's concern? Or is it the responsibility of the local voters to "dis-elect" them?

Snowflack doesn’t define the terms “rich and affluent”, as those terms generally aren’t when thrown around in discussions about government spending and taxes. Do they refer to families earning more than $70,000 or $100,000 per year, or is there some other dollar amount that places people in the “rich and affluent” categories? Who knows?

Here’s what we do know. More state aid to municipalities would be considered more property tax relief, but as has been widely reported, state aid has been flat-funded for the past four years (except for the 31*) and will be again in this year’s budget.

However, during those same five years, income tax revenue (the Property Tax Relief Fund) has grown from $7,195,390,000 per year in 2003 to $11.615,000,000 in Corzine’s 2007 budget. That’s billions more dollars in the Property Tax Relief Fund and a zero dollar increase to nearly every one of the state’s 566 municipalities, with the exception of the 31*. People with the same income, will receive wildly different amounts in property tax relief depending upon where they live.

We also know that as of 2003, New Jersey's median family income was $70,263 and the median income for a household in Morris County was $79,977. We know property tax rebates will not increase this year as promised. Taxpayers with incomes of $70,000 or more will not receive a rebate (previous cut off was $200,000) and with the exception of senior citizens and the disabled, all eligible homeowners will have their rebate cut by $100. So it makes no difference where you live, but you can bet that a small percentage of the $1.2 billion in rebate checks will find a way to Morris County.

We know municipal aid has been flat-funded for five years* and that the state’s Property Tax Relief Fund has increased by billions in the past 5 years. We also know who paid for most of it. New Jersey households reporting over $100,000 in income account for 80 percent of the state’s income tax revenue and 42 percent of state income taxes are paid by 1 percent of filers.

Since 2004, $7 billion in additional income taxes have been spent on property relief, where’d it go? This might provide a clue. The 31 “needy” municipalities spend 30 percent more per student as compared to the rest in the state. The 31* were demanding $500 million more in property tax relief this year.

Average per-pupil spending in New Jersey districts is $11,056. Abbott districts average $14,287, led by Asbury Park's $18,893.Here’s what state attorney general, Zulima Farber had to say:

New Jersey's 31 neediest school districts want too much money, and the state can no longer afford their increasingly high demands, the state attorney general told New Jersey's Supreme Court yesterday.Here’s what New Jersey Department of Education Commissioner Lucille Davy had to say:

"We have gotten to a point where the supplemental funding requests of some districts are truly shocking."

“I'm concerned that we're spending $18,000 a kid in Asbury Park, for example, and their results are near the bottom in almost any measure”. "We need to figure out why we are not getting the outcomes," she said. "It's clearly not a matter of resources."Here’s how Snowflack’s newspaper described the situation in the fall of 2005:

The criteria set for Abbotts was that they be funded to achieve parity with the state's wealthiest districts. A brief filed by acting Education Commissioner Lucille Davy shows the Abbotts are already getting $500 million in aid above the parity level.

Property taxes in New Jersey are bad. In Morris County, they're even worse.As for whether people living in a Morris County municipality, or similar community in New Jersey, are being treated fairly or mistreated by state government depends upon your definition of the terms. If fair treatment means paying more income taxes every year and seeing no additional property tax relief flow back into your community, than of course it’s completely fair. If fair means “needy” cities wind up spending more per student than “wealthier” towns, then of course the state government is being fair and providing equal treatment. If fair means two people with the same income don’t benefit similarly from state aid, then yea, that’s fair. But, those who base their opinions on common sense and facts may see things differently.

It's not just that wealthy districts get less aid, it's that often -- as in the current state budget -- no increase is given at all, noted Edwina M. Lee, NJSBA executive director. "Another year of flat funding makes it extremely difficult for our districts to maintain their existing programs," she said.

We have to laugh at some people who actually believe the myth that Fred Snowflack has a clue.

* Thirty-one of the state’s 566 municipalities are designated as “Abbott” for the purposes of “property tax relief” related to education aid and “needy” for the purposes of “property tax relief” related to all other municipal aid. The 31 municipalities designated as “Abbott” and “needy” were not subjected to the zero growth in “property tax relief” until the 2007 budget.

Update: Factcheck Lady pointed out his name is spelled SnowFlack, not SnowFlake. Since corrected.

New Jersey Sales Tax Increase Squandered On Pork

“The state is pretty much broke”, declared New Jersey Governor Jon Corzine during his budget unveiling speech in March.

What was the Governor’s solution to the problem? The first thing Corzine did was to borrow, adding $6.4 billion to the state’s debt, structured such that repayment balloons from 2011 through 2041. Next, Corzine proposed a budget to increase state spending by 9.2 percent and to levy $1.8 billion in new taxes.

Corzine has insisted the tax hike - from 6 percent to 7 percent - is needed to close the state's recurring budget gap.

To gain support for his new taxes, Corzine shut down state government to force lawmakers to accept his budget and tax increases. He protected state employees, agreeing to pay them for any days not worked during the shut down. The losses in taxes to the state and income by private citizens were to be borne by those held hostage. To add insult to injury, Corzine then broke out the taxpayers’ checkbook:

Lawmakers estimate that majority Democrats added more than $300 million in such projects - called "pork" or "Christmas tree ornaments" - in the hours before the Legislature passed the spending plan early Saturday morning.You know things are bad when David Rebovich, political science professor at Rider University, can’t put a positive spin on the tax and spend frenzy. The tax increases weren’t used to place state government on a sound financial footing; they were frittered away on new spending.

"That means state government was closed for eight days to gain an additional $300 million in revenue, which is 1 percent of the budget," Rebovich said. "That's not a headline that the governor or Democratic legislators want out there."Call it “property tax relief” in you like, $200,000 for a diesel-powered electric generator in West Deptford, $40,000 for roof repair to the Barnsboro Fire House, $110,000 for sidewalks in Logan Township, $24 million more for Newark and $4 million more for Trenton for God knows what. And on and on the spending list goes.

He added: "In what we're told is the beginning of a major downsizing in government, it's surprising that [Corzine] allowed so much additional spending to be added in the wee hours of the night."

So there you have it. After all is said there done, there was no downsizing of New Jersey’s government. Tax increases were gobbled up by even more new spending and the state begins next year with a $2 billion budget hole.

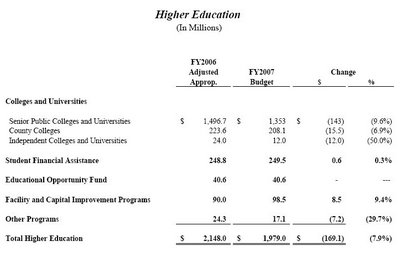

Proposed Funding Cuts To Higher Education Restored in New Jersey’s Budget

However, a reading of the original budget revealed ‘one-time’ appropriations of $46 million from the previous year were included to come up with the $169 million figure. The true cut was $123 million, albeit in response to the waste, fraud and corruption recently uncovered in New Jersey’s institutions of higher learning. Update: Here’s a screen capture from page 73 of the original budget - Click picture to enlarge.

During the course of the budget battle, $132 million for higher education was added back into the budget that was ultimately signed by Corzine. Under the most liberal interpretation, funding for higher education was cut by $37 million. In reality, funding for higher education was increased by $9 million.

Here’s a screen capture from page 8 of the original budget. As you can see, overall spending was slated to increase $2.6 billion, a 9.2 percent increase over 2006. No one ever got around to identifying the other major budget cuts and for good reason, there weren’t any. Now that funding for higher education has been restored, can we all agree there are no cuts in Corzine’s budget?

The History of New Jersey Property Tax Relief

Contrary to popular belief, New Jersey’s income tax revenue can not be used to reduce state debt, to make contributions to state worker pension funds, to build state roads, to pay for Charity Care, to provide state security or for any other state expense. It can only be used for “property tax relief”.

The state provides “property tax relief” indirectly, by granting aid to local government (municipalities and counties) and directly, with property tax rebates/credits to homeowners and renters. Indirect “property tax relief” is granted in the form of school aid and municipal aid to local governments.

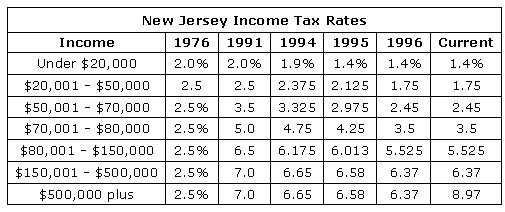

New Jersey’s Property Tax Relief Fund began working its magic under Democrat Governor Brendan Byrne in 1976 and by 1977, state income tax collections totaled $764,623,000. Initially there were two income tax brackets and rates. (see tax rate chart below).

Republican Governor Tom Kean was in office when the state income tax marked its ten-year anniversary. By 1986, the Property Tax Relief Fund had swelled to nearly three times its original size, to $2,227,740,000. The Fund grew throughout Kean’s two terms as governor without any hikes to state income rates.

But in 1991, Democrat Governor Jim Florio called for more ”property tax relief” and income tax rates were increased for “the wealthy”, people with incomes of $50,000 or more. Six income brackets were created and tax rates became more progressive (see tax rate chart below).

By the time Florio was swept from office in 1993, the Property Tax Relief Fund was at $4,325,304,000. Some New Jerseyans were beginning to catch on to the absurdity of paying more state taxes in order to have some portion of their money returned in “property tax relief”.

In 1994, newly elected Republican Governor Christie Whitman followed through on a campaign promise to reduce income tax rates over a three-year period, 1994 through 1996. As you can see from the chart below, the tax rate cuts were skewed more favorably to the lower and middle income groups, but all brackets received rate reductions.

State income tax collections increased every year the Whitman/ DiFrancesco administration was in office and by 2001, the Property Tax Relief Fund totaled $7,989,222,000, nearly double the amount when Whitman took office in 1994.

By the summer of 2004, beleaguered Democrat Governor Jim McGreevey decided more "property tax relief" was in order. He created the ”millionaires tax” and had it enacted retroactively to January 1, 2004. The “millionaires tax” amounted to the creation of a new income tax bracket and a higher rate for residents with incomes over $500,000 (see tax rate chart below).

By the time McGreevey was forced to resign from office in 2004, the Property Tax Relief Fund was pulling in $7,156,770,000, $800 million less than when the Whitman/ DiFrancesco administration left Trenton in 2001.

The reduction in the state’s income tax revenue was due to the progressive nature of New Jersey’s income tax structure. Total personal income in New Jersey had actually increased every year McGreevey was governor, but income and the number of taxpayers in the higher tax brackets had declined, therefore, state income tax revenue fell.

New Jersey households reporting over $100,000 in income account for 80 percent of the state’s income tax revenue and 42 percent of state income taxes are paid by 1 percent of filers. When taxpayers in the higher income tax brackets leave the state, lose their jobs or make less money, New Jersey’s Property Tax Relief Fund takes a nose dive.

To the good fortune of all, the “Republican-Bush tax cuts’ fueled unprecedented economic growth and by 2005, Democrat Governor Dick Codey saw state income tax revenue grow to $9,537,938,903 and by 2006 it hit $10.335,000,000. At that point, New Jersey’s Property Tax Relief Fund had grown by more than $3 billion since McGreevey’s resignation in 2004.

Enter Democrat Governor Jon Corzine who estimates the Property Tax Relief Fund will post a balance of $11.615,000,000 in 2007. That’s $1.3 billion more than last year and it may turn out to be even more. Corzine’s plan to reduce state income rates for filers with incomes of $30,000 or less, was eliminated from the new budget.

However in July 2006, Democrats decided more property tax relief was needed to counter the 40 percent rise in property taxes since their Party had taken control of state government in 2002. After much wrangling and a shut down of state government, Corzine announced a plan to raise the state’s sales tax, but to set aside some of the new revenue for “property tax relief”.

When the smoke cleared and the dust settled on New Jersey’s budget for 2007, state aid to municipalities ( “property tax relief”) remained flat, just as it had for the previous four years*. Property tax rebates were not increased as promised and some residents, lucky enough to qualify for the program, discovered their rebate will be cut $100, providing $250 in direct “property tax relief”.

Since 1976, the New Jersey Property Tax Relief Fund will have cost taxpayers $134,836,871,000 in income taxes. Billions more have been granted in "property tax releif" from the state’s other tax and revenue sources. Yet three decades later, the state still has the highest property taxes in the nation.

Of course, the only way to actually provide tax relief is to reduce spending and cut taxes. After thirty years, you’d think New Jerseyans would wise up to this fact.

We’ll see. Governor Corzine has announced he’s working on a new “property tax relief” plan and Senator Robert Menendez is calling for a repeal of the “Bush tax cuts” for the “wealthy”. Menendez apparently hasn’t discovered that for the purposes of federal tax calculations, New Jerseyans are “the wealthy”. Corzine continues to search for a new way to rob Peter to pay Paul or to just rob Peter and call it “property tax relief”.

* Thirty-one of the state’s 566 municipalities are designated as “Abbott” for the purposes of “property tax relief” related to education aid and “needy” for the purposes of “property tax relief” related to all other municipal aid. The 31 municipalities designated as “Abbott” and “needy” were not subjected to the zero growth in “property tax relief” until the 2007 budget.

Labels: New Jersey, Property Tax Relief