What's The Matter With New Jersey II

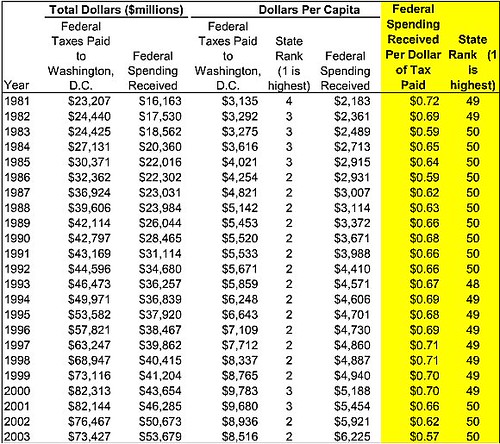

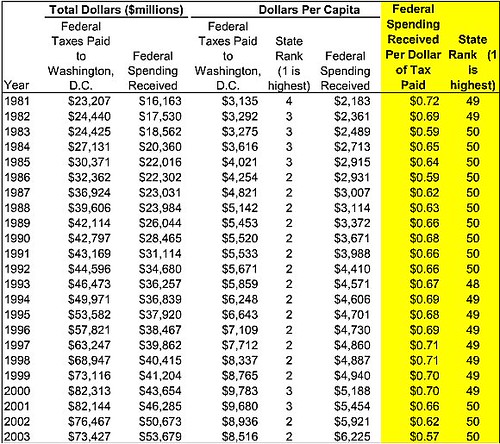

One major reason New Jersey receives only 57 cents for every tax dollar we send to Washington - the federal income tax code. High cost-of-living/ high income states pay more in taxes because of the progressive nature of the federal income tax code, the Alternate Minimum Tax and estate tax laws. (The chart below shows New Jersey’s federal taxes paid and received in return from 1981 to 2003.)

The second reason - the majority of government programs are designed to redistribute wealth – New Jersey is "wealthy" and so the state is merely paying its "fair share" by the standards of "progressive Democrats".

High and progressive tax rates, the Alternative Minimum Tax and the federal estate tax (death tax) - all policies that thrill "progressives" when applied to individuals - are now advanced as proof of a Republican conspiracy to punish “blue states”. What a shock to discover a collection of "wealthy" people – New Jersey taxpayers – pays more taxes per capita than a collection of people in lower cost-of-living/lower income states.

New Jersey's taxpayers should take note of how well New Jersey made out during the "Bush tax cuts for the wealthy" years (lower per capita taxes-higher per capita return) as opposed to the Clinton years.

You have to scratch your head and wonder why Jon Corzine and other "progressive Democrats", supposedly representing New Jersey's taxpayers, oppose income tax cuts in general and the Bush tax cuts in particular.

Thankfully, voters in the "red states" have a better sense of fairness as it applies to the federal tax code and understand the benefits of allowing people to keep more of the money they earn – everyone in the country benefits.

The second reason - the majority of government programs are designed to redistribute wealth – New Jersey is "wealthy" and so the state is merely paying its "fair share" by the standards of "progressive Democrats".

High and progressive tax rates, the Alternative Minimum Tax and the federal estate tax (death tax) - all policies that thrill "progressives" when applied to individuals - are now advanced as proof of a Republican conspiracy to punish “blue states”. What a shock to discover a collection of "wealthy" people – New Jersey taxpayers – pays more taxes per capita than a collection of people in lower cost-of-living/lower income states.

New Jersey's taxpayers should take note of how well New Jersey made out during the "Bush tax cuts for the wealthy" years (lower per capita taxes-higher per capita return) as opposed to the Clinton years.

You have to scratch your head and wonder why Jon Corzine and other "progressive Democrats", supposedly representing New Jersey's taxpayers, oppose income tax cuts in general and the Bush tax cuts in particular.

Thankfully, voters in the "red states" have a better sense of fairness as it applies to the federal tax code and understand the benefits of allowing people to keep more of the money they earn – everyone in the country benefits.

New Jersey

Federal Taxes Paid vs, Federal Spending Received

1981 - 2003

Federal Taxes Paid vs, Federal Spending Received

1981 - 2003

2 Comments:

So much useful data for everyone!

jobs in Halifax | swing sets for kids | malpractice insurance for social workers | oil etf | business bankruptcy lawyers

I read really much useful data here!

Post a Comment

<< Home