NJ Election 2006 – Taxes and The U.S. Economy

The editors of the Star-Ledger in their article, The best choices in the House races”, tell us that: “Taxes and the economy are a major focus of the campaign in the 7th District”. Why just the 7th remains unclear. We believe most voters in New Jersey are focused on those issues, although little ink has been spilled by the state’s largest paper on the facts surrounding federal taxes and the U.S. economy.

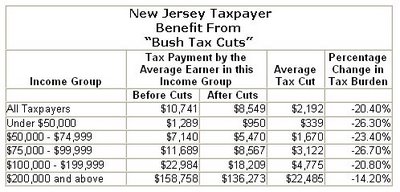

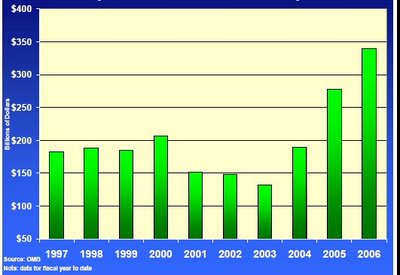

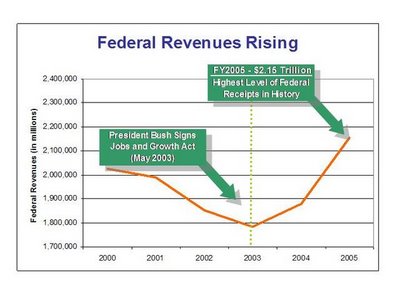

We believe most voters favor keeping the U.S. economy growing as it has for the past 19 consecutive quarters since the “Bush tax cuts” were enacted. These tax cuts have facilitated a growing economy, low unemployment, federal tax revenues at record levels, the stock market hitting all-time highs, as well as, a shrinking U.S. budget deficit. Not to mention the side benefit of saving every New Jersey taxpayer money (see chart below).

Given the choice between a candidate who favors retaining the “Bush tax cuts” and one who favors repealing them, it seems an obvious choice in the 7th. Vote for Congressman Mike Ferguson. The Star-Ledger explains, “Ferguson is an enthusiastic booster of President Bush's tax policy and the effort to make his cuts permanent”. But, the Star-Ledger has endorsed Linda Stender because she favors repealing most tax cuts and therefore, the editors conclude, “Stender should represent the people of the 7th District”.

Here’s how the Star-Ledger described Stender’s position and record earlier this month “She wants to repeal most of the Bush tax cuts” and “she's been party to the mess Democrats have made in Trenton, supporting all the spending and tax increases since her election in 2001.” Wow, voters should be rushing to the polls to elect Stender. We’ll see.

The Ledger uses the same “logic” for their endorsement in New Jersey’s 5th Congressional District. They describe Congressman Scott Garrett as ”a traditional conservative who can also be stubbornly independent of his party”, but endorses Paul Aronsohn because he “opposes making permanent the Bush tax cuts”.

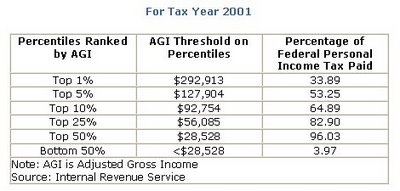

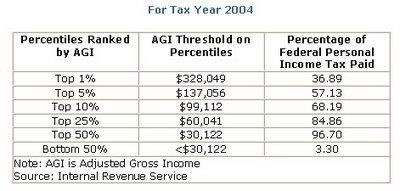

As the facts clearly show, the “Bush tax cuts” have increased the federal tax burden on “the rich”, tripled corporate tax revenue, and now the U.S. Treasury is raking in record amounts of tax receipts. The budget deficit has been cut in half since the recession of 2001and taxed-to-death New Jersey taxpayers have been able to keep more of their own money. We’d call those accomplishments. (See charts below)

The notion that increasing taxes would not adversely affect the U.S. economy defies economic logic. Governor Jon Corzine, hardly one to shy away from tax increases, has been fending off his own party’s calls for raising New Jersey’s income and business taxes because he recognizes the negative impact these increases would have on the state’s economy and treasury.

Government can create tax polices that either hinder or enable economic growth, but it can not create wealth, it can only take it away. We the people grow the economy though our investment and hard work, not the government or politicians. The “Bush tax cuts” produced an environment conducive to higher levels of investment, entrepreneurship, productivity and the creation of new jobs. The American people responded and produced.

Tax increases on work and investment, as the Democrats endorsed advocate and the Ledger applauds, would have the opposite effect. It shouldn’t come as news to anyone that if you tax something you get less of it – think of the so-called sin and carbon taxes.

The Ledger and the other usual suspects have yet to explain how raising federal taxes would benefit the people of New Jersey. Fewer dollars in the wallets of New Jersey taxpayers is not a boon to anyone in the state – from the richest to the poorest.

The state of New Jersey receives the lowest percentage of federal funds for every dollar our taxpayers send to Washington because we are “the richest” state in the Union. Just as the wealthier communities in New Jersey receive the least amount of municipal and school aid from the state, so it goes with federal aid to New Jersey. No matter the tax rates, no matter who controls the Congress or White House, as long as the state has a higher average income than the rest of the states, it will remain that way.

New Jerseyans don’t pay enough in taxes – federal, state and local? Give us break. We’ve lost all hope on the editors of the Star-ledger, but you can send a message this November 7th. Send the tax increasing politicians packing.

We believe most voters favor keeping the U.S. economy growing as it has for the past 19 consecutive quarters since the “Bush tax cuts” were enacted. These tax cuts have facilitated a growing economy, low unemployment, federal tax revenues at record levels, the stock market hitting all-time highs, as well as, a shrinking U.S. budget deficit. Not to mention the side benefit of saving every New Jersey taxpayer money (see chart below).

Given the choice between a candidate who favors retaining the “Bush tax cuts” and one who favors repealing them, it seems an obvious choice in the 7th. Vote for Congressman Mike Ferguson. The Star-Ledger explains, “Ferguson is an enthusiastic booster of President Bush's tax policy and the effort to make his cuts permanent”. But, the Star-Ledger has endorsed Linda Stender because she favors repealing most tax cuts and therefore, the editors conclude, “Stender should represent the people of the 7th District”.

Here’s how the Star-Ledger described Stender’s position and record earlier this month “She wants to repeal most of the Bush tax cuts” and “she's been party to the mess Democrats have made in Trenton, supporting all the spending and tax increases since her election in 2001.” Wow, voters should be rushing to the polls to elect Stender. We’ll see.

The Ledger uses the same “logic” for their endorsement in New Jersey’s 5th Congressional District. They describe Congressman Scott Garrett as ”a traditional conservative who can also be stubbornly independent of his party”, but endorses Paul Aronsohn because he “opposes making permanent the Bush tax cuts”.

As the facts clearly show, the “Bush tax cuts” have increased the federal tax burden on “the rich”, tripled corporate tax revenue, and now the U.S. Treasury is raking in record amounts of tax receipts. The budget deficit has been cut in half since the recession of 2001and taxed-to-death New Jersey taxpayers have been able to keep more of their own money. We’d call those accomplishments. (See charts below)

The notion that increasing taxes would not adversely affect the U.S. economy defies economic logic. Governor Jon Corzine, hardly one to shy away from tax increases, has been fending off his own party’s calls for raising New Jersey’s income and business taxes because he recognizes the negative impact these increases would have on the state’s economy and treasury.

Government can create tax polices that either hinder or enable economic growth, but it can not create wealth, it can only take it away. We the people grow the economy though our investment and hard work, not the government or politicians. The “Bush tax cuts” produced an environment conducive to higher levels of investment, entrepreneurship, productivity and the creation of new jobs. The American people responded and produced.

Tax increases on work and investment, as the Democrats endorsed advocate and the Ledger applauds, would have the opposite effect. It shouldn’t come as news to anyone that if you tax something you get less of it – think of the so-called sin and carbon taxes.

The Ledger and the other usual suspects have yet to explain how raising federal taxes would benefit the people of New Jersey. Fewer dollars in the wallets of New Jersey taxpayers is not a boon to anyone in the state – from the richest to the poorest.

The state of New Jersey receives the lowest percentage of federal funds for every dollar our taxpayers send to Washington because we are “the richest” state in the Union. Just as the wealthier communities in New Jersey receive the least amount of municipal and school aid from the state, so it goes with federal aid to New Jersey. No matter the tax rates, no matter who controls the Congress or White House, as long as the state has a higher average income than the rest of the states, it will remain that way.

New Jerseyans don’t pay enough in taxes – federal, state and local? Give us break. We’ve lost all hope on the editors of the Star-ledger, but you can send a message this November 7th. Send the tax increasing politicians packing.

Tax Savings For Every New Jersey Taxpayer

1 Comments:

It will not succeed in reality, that's exactly what I think.

here

Post a Comment

<< Home