New Jersey Public School Funding Inequities

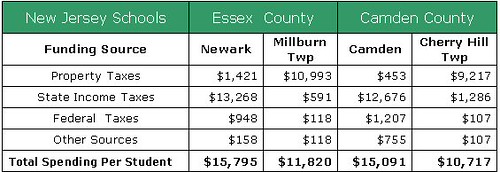

New Jersey school district A spends an average of $15,795 per student and school district B spends an average of $11,820 per student. Both school districts are in the same New Jersey county. One school district is considered affluent and the other poor. School district A spends 33% more per pupil than school district B.

School district B's schools are funded: 93% from local property taxes, 5% from state funds (NJ income taxes), 1% from federal funds (federal taxes), 1% from fund balances.

School district C's schools are funded: 3% from local property taxes, 84% from state funds (NJ income taxes), 8% from federal funds (federal taxes) and 5% from fund balances.

School district D's schools are funded: 86% from local property taxes, 12% from state funds (NJ income taxes), 1% from federal funds (federal taxes), 1% from other sources.

A 2) School district C is Camden and school district D is Cherry Hill Township, both are located in Camden County. Camden spending $15,091 per student is considered poor and Cherry Hill Township spending $10,717 per student is considered middle class.

A 3 & 4) If the purpose behind the allocation of state funds to local school districts is to achieve funding parity, then clearly the state funding is out of whack and obviously unfair.

A 5) The inequity in spending per pupil, as well as, inequity in state and federal school funding causes crushing property tax burdens in every school district that is short changed under New Jersey’s allocation formula. Millburn and Cherry Hill are just two examples of the state-wide problem.

A 6) One-hundred percent (100%) of New Jersey’s state income tax revenue is used for school funding. No other programs or services are funded with the state’s income tax.

Q 1) Which school district is considered affluent, school district A or B?New Jersey school district C spends an average of $15,091 per student and school district D spends $10,717 per student. Both school districts are in the same New Jersey county. One school district is considered middle class and the other poor. School district C spends 40% more per pupil than school district D.

Q 2) Which school district is considered middle class, school district C or D?School district A's schools are funded: 9% from local property taxes, 84% from state funds (NJ income taxes), 6% from federal funds (federal taxes) and 1% from other sources.

School district B's schools are funded: 93% from local property taxes, 5% from state funds (NJ income taxes), 1% from federal funds (federal taxes), 1% from fund balances.

School district C's schools are funded: 3% from local property taxes, 84% from state funds (NJ income taxes), 8% from federal funds (federal taxes) and 5% from fund balances.

School district D's schools are funded: 86% from local property taxes, 12% from state funds (NJ income taxes), 1% from federal funds (federal taxes), 1% from other sources.

Q 3) Is it fair that school district A, located in the same country as school district B, spends 33% more per student?A 1) School district A is Newark and school district B is Millburn Township, both are located in Essex County. Newark spending $15,795 per student is considered poor and Millburn Township spending $11,820 per student is considered rich.

Q 4) Is it fair that school district C, located in the same country as school district D, spends 40% more per student?

Q 5) What effect does the disparity in spending per pupil and the inequity in state and federal funding to the local school districts have on property taxes in school districts B and D?

Q 6) What percent of New Jersey’s income tax revenue is returned to municipalities in the form of school aid and what percent is used to fund other state programs and services?

A 2) School district C is Camden and school district D is Cherry Hill Township, both are located in Camden County. Camden spending $15,091 per student is considered poor and Cherry Hill Township spending $10,717 per student is considered middle class.

A 3 & 4) If the purpose behind the allocation of state funds to local school districts is to achieve funding parity, then clearly the state funding is out of whack and obviously unfair.

A 5) The inequity in spending per pupil, as well as, inequity in state and federal school funding causes crushing property tax burdens in every school district that is short changed under New Jersey’s allocation formula. Millburn and Cherry Hill are just two examples of the state-wide problem.

A 6) One-hundred percent (100%) of New Jersey’s state income tax revenue is used for school funding. No other programs or services are funded with the state’s income tax.

12 Comments:

What's worse is that the "poorer" districts clearly outperform the "Richer" districts in virtually every measurement. The key is to look at the total dollars that make their way into the classroom.

Excellent post. Mulshine uses Middletown (not nearly as affluent as Milburn) as his example of this point.

You are forgetting that taxpayers in School B & D are also paying considerably higher taxes than those in school A & C so it is a double whammy for them. They are in fact not only paying 90% for their own school, they are paying a large % of school A & C's expenses as well. The plans to shift taxes from property taxes to income taxes are just a "shell game" for most School B, and many school school D, taxpayers. The Abbott's should be limited to spending no more than the District J schools -- at least that would cut some of the expense. Are you sure 100% of income tax currently goes to fund schools? How does the state pay for the "other stuff"?

Most people don't realize that 100% of New Jersey’s income tax is sent back to municipalities as “property tax relief.”

By law the New Jersey income tax can be used for no other purpose. The news doesn’t do a very good job in informing people of that little fact do they?

The state pays for other "stuff" through sales, corporate and other taxes and fees.

Yes, we know the current school funding is a double whammy and have write about that very subject many times on this blog.

For many homeowners, they first pay between 80 – 100% of the total cost to fund their local schools through their property taxes. Next they pay their income taxes to fund schools in other communities that spend considerably more per student than does their own school district.

Special interests rule the state. It’s time for the power of the purse to be returned to the people of New Jersey and for all citizens it be treated equally.

By that we don’t mean jacking up more taxes to fund schools at the Newark and Camden level, rather we mean reducing per pupil spending in the Abbots to the average of the non-Abbott school districts. Do that and the state will have billions in funds for real property tax relief for every homeowner, not just those “special people” chosen by Jon Corzine.

The Corzine property tax plan - average homeowner increase in rebate =$68, average increase in rebate for senior citizens = $150.

IS that the "REAL Corzine Property Tax Plan" of which you speak?

http://www.corzineconnection.com/story/2005/6/1/14944/15607#commenttop

Don't you think it would also help if citizens got to vote on Municipal, county and state budgets -- not just local school budgets? My vote goes to whoever lets me vote on the county and state budgets.

I read this and I can't help but wonder if all that money is actually getting to places where it would help teach students.

It sure doesn't seem that way, just from looking at the numbers.

Tami, the money is going directly to the schools. I'll let you decide if the schools the money is going to actually is a place where it would help teach students.

Perhaps we shouldn't blame the teachers - if an anti-school attitude has been ingrained into a culture, all the money in the world won’t make a difference, as you can see from the spending per student in Camden and Newark.

We believe the parents are to blame for the poor scores for so many students in the Abbott districts.

Until these communities value education and hold their children accountable, we will not see results.

The school funding issue is surely not an easy one. There are so many factors to consider in the equation. Please keep in mind that it actually costs more to educate a child from an underpriveledged area due to the high need for extra services...such as ESL teachers, breakfast programs, early intervention programs etc.. Some school districts will need more than others to help their student population achieve.

Goodness, there's so much useful data here!

site

I absolutely tie in with anything you've presented us.

Really helpful data, thank you for the post.

here|this site|at this shop|erectile dysfunction-|-|-|-random-} | here|this site|at this shop|weight loss pills-|-|-|-random-} | here|this site|at this shop|erectile dysfunction-|-|-|-random-}

Poorer districts out-performed the richer ones? How ironic! Taxes from casinos should be diverted to more quantifiable benefits that the people of New Jersey rightfully deserve.

Post a Comment

<< Home